Money Machine, Passive Money and Real Estate Investment – Strategies by Alex Fischer

Be happy? Be successful? How does it work?! In Richer Than Than Life you learn from one of the best In 3 parts it is about your mindset, the right tools and the know-how to earn money through cash flow, passive cash flow, equity, your first property, and much more! So the 3rd part is about building a money machine. That sounds good! In more than fifteen episodes you will learn how to create your own business model that generates passive income at the beginning, up to the topic of real estate as an investment tool and… but let’s start at the beginning. Here are a few of the many, many learnings you will get in the podcast “Richer than the Geissens” from Alex Fischer. This review is about the 3rd part of “Richer than the Geissens”. Important: Be sure to listen to part 1 and part 2 as well, otherwise you will not understand many of the principles and strategies in part 3!

“Richer than the Geissens” – Amazon Bestseller

The book “Richer than the Geissens” contains extremely many details about the strategies. If you listen to all chapters in a structured way and repeat some of them, you will learn how to become financially, professionally and privately successful. The review gives you only a small insight, an appetizer to the many aspects the book gives you.

Remember: Listen to part 1 & 2 first, then part 3!

Important: Currently the book is only available in Germany! I speak German and discovered this book or podcast two weeks ago. Even if you wouldn’t understand a word in the podcast, I wanted to introduce some of the methods and strategies to you!

Why should you listen to this podcast?

This review should make you want more! I have listened to it twice in the meantime, simply because there is so much to learn! In the podcast or audio book offers hundreds of information, examples, tips, methods and strategies. All learnings are structured from episode 1 to the end in episode 79. Despite a lot of content, so that everything is conveyed as effectively as possible, the most important contents and questions are repeated at the end of each episode. This way the learning effect is greatest!

The audio book by Alex Fischer contains a lot of know-how. Know-how for those who start with 0 Euro starting capital and also for those who have already saved money for their first property. The book is for:

- People with 0 Euro equity with employee or employee status

- People with initial, small equity reserves of 50,000 euros

- People who already own 1 or 2 properties and want to learn how a property works as an investment tool.

My review focuses on those who, like me, are at a point where they have initial, small equity capital of up to around 50,000 euros and the first permanent employees are already working in their own company.

“Richer than the Geissens” is such a strong companion, from the start and the best, individual setting for cash flow to the real estate as an investment tool. Accordingly, it is worth repeating individual chapters after some time, because you will quickly develop further with the learnings from “RADG”.

PS: RADG is read by Alex Fischer and Gordon Gekko’s dubbing actors from the film “Wolf Of Wallstreet”.

Top sellers: 200,000 readers

Over 200,000 readers have read Alex Fischer’s strategies. On YouTube his videos on real estate, taxes & Co. reach partly more than 500.000 views. Alex Fischer is definitely the leader when it comes to combining modern online marketing and real estate. He passes on his beliefs, stories and strategies and in the 3rd part it gets very concrete, now it’s time to earn money. How? That’s what I want to outline for you. If you want more, get the audio book for free on Spotify and iTunes:

The money machine successfully built and operated

As described above, this review is about the 3rd part of “Richer than the Geissens”. Be sure to listen to part 1 and part 2 as well, otherwise you will not understand many of the principles and strategies in part 3.

I also streamed the audio book in several stages. That means distributed listening to really internalize all the learnings, as well as repetitions of individual episodes that are very interesting for me. The 3rd part is then about building your money machine. In more than fifteen episodes you will learn how to create your own business model that generates passive income, including the topic of real estate as an investment tool and… but let’s start at the beginning. Here are a few of the many, many learnings you get in the podcast “Richer than the Geissens” by Alex Fischer himself.

But first it is important to set up a big goal. You will quickly understand this goal while listening to the podcast.

“30 days off per month!” – Alex Fischer

This may sound unrealistic at first, but if one looks at the passive money flows installed step by step, this goal quickly seems to make sense. Because, as already learned in episode 43, there is a difference between “self-employed” and “entrepreneurs”. The self-employed spend their time on money. Entrepreneurs create structures and machines that earn money.

Excursus – In “Richer than the Geissens” Alex Fischer draws a line between the terms ‘being self-employed’ and ‘being an entrepreneur’. Self-employed people exchange their time for money by taking orders and doing work. You should be an entrepreneur! Why? Entrepreneurs build themselves a productive machine. This machine constantly and regularly generates cash flow. That means, as an entrepreneur you arrange your income in such a way that it is constantly increased without your own and immediate action. How this works is explained in the following episodes of the podcast, or in Episode 43: With great power comes great responsibility.

So the point is to achieve this goal of 30 days off per month. How do you start? Best with the first step. By setting up money machines. Alex Fischer explains this in detail in the podcast. Because only through the money machine you create passive sources of income.

How can such a passive source of income look like? He gives many examples. Here a simple one, in this one Alex Fischer tells about one of his friends. This acquaintance deals with real estate. With every new contract she offers a cheaper insurance. So she earns money with each conclusion by a signature and gets also in the future annually a commission, as long as the insurance is active. This is one of many examples of passive income! In the Podcast Alex Fischer goes much deeper and gives different examples from different industries.

Collect passive money streams

As with the well-known quote, many streams become a torrential river, for you it is also about collecting various passive money streams. So many that you earn yourself your first days off. Your big and overriding goal is then 30 days off per month. So that after Alex Fischer you never have to exchange time for money again! Cost pressure and lack of passive cash flow make you do things you don’t want to do. This cost pressure keeps you in the famous “hamster wheel and chains you to the ground”.

In Episode 54: Setting up the money magnet Alex goes into the money magnet once again in much more detail.

At this point the listener quickly realizes that the money magnet will be extremely important, because Alex Fischer repeats no other tip in “Richer than the Geissens”. This underlines how important it is to deal with the setup of your own money magnet.

Digression – How does the money magnet work? Take 10% of your income (private) or 10% of your contribution margin (entrepreneur) and put it into a savings account. You never touch this account. In principle, the money magnet is so simple that it is slightly underestimated according to Alex Fischer. Error 2: It is often destroyed again. But tests and success reports have proven the success thousands of times. In order for your money magnet to work, you must follow these 3 rules. Rule 1) Take 10% of your income (private) or 10% of your contribution margin (entrepreneur) and put it into a savings account. Rule 2) never touch this account! Rule 3) Never! Alex Fischer explains in detail with stories from his own life why this money magnet has changed everything for him. But he also explains that it is not about this account making you rich. The account ensures that “more and more money is attracted”. This account changes the mindset of people. Alex Fischer explains exactly how the money magnet works in Edition 25: Building instructions for a money magnet.

In addition, you need to focus on activating passive cash flow, which gives you financial freedom. Because running costs take your breath away, like Alex Fischer in Folume 55: Analyse and reduce costs. Only when you have enough passive cash flow can you afford to increase your costs.

PS for employees: Salary increase

I wanted to insert one point of the audio book for employees. The first question: Are you making a profit for your company, your boss? If so, ask yourself the second question: How many times have you asked for a pay rise? PS: Of course only if they are justified by your performance in the company.

Away from the podcast, I wanted to take a look at some current facts and figures with you. More precisely, the active demand regarding salary increases and promotions in Germany.

Statistics on salary increases and promotions

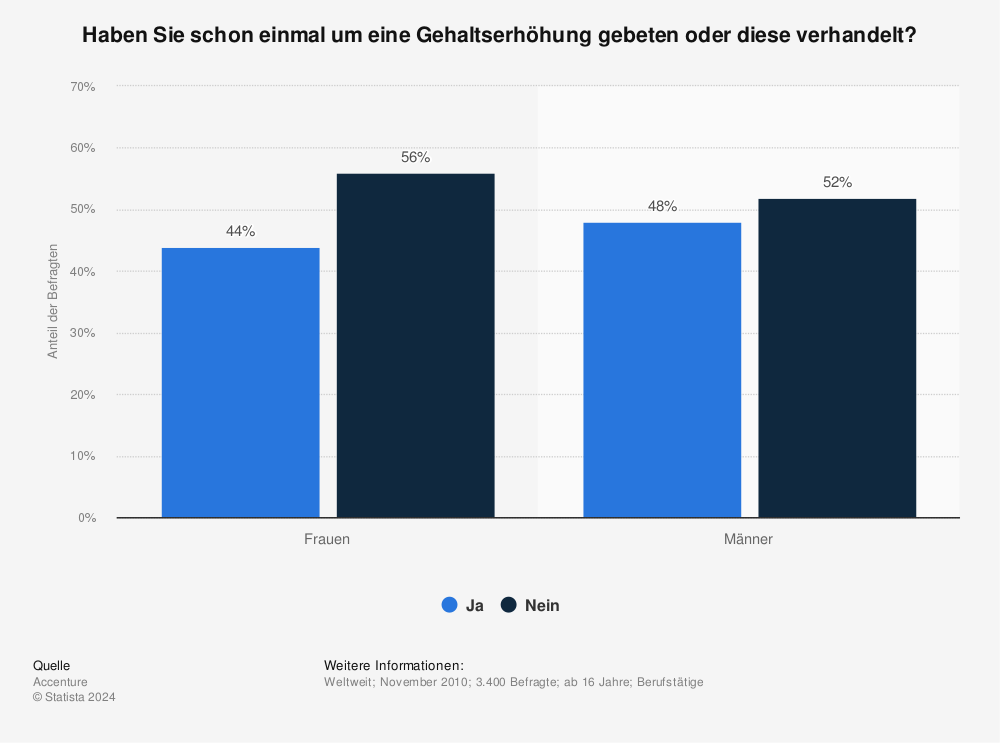

The first survey by the Federal Statistical Office shows the distribution of men and women who actively asked for a salary increase. The result: Less than half of the employees have ever asked for a salary increase! The distribution between men and women is almost equal. Men have a small lead of +4%.

- Women / Yes: 44% (-4%)

- Men / Yes: 48%

- Women / No: 56% (+4%)

- Men / No: 52%

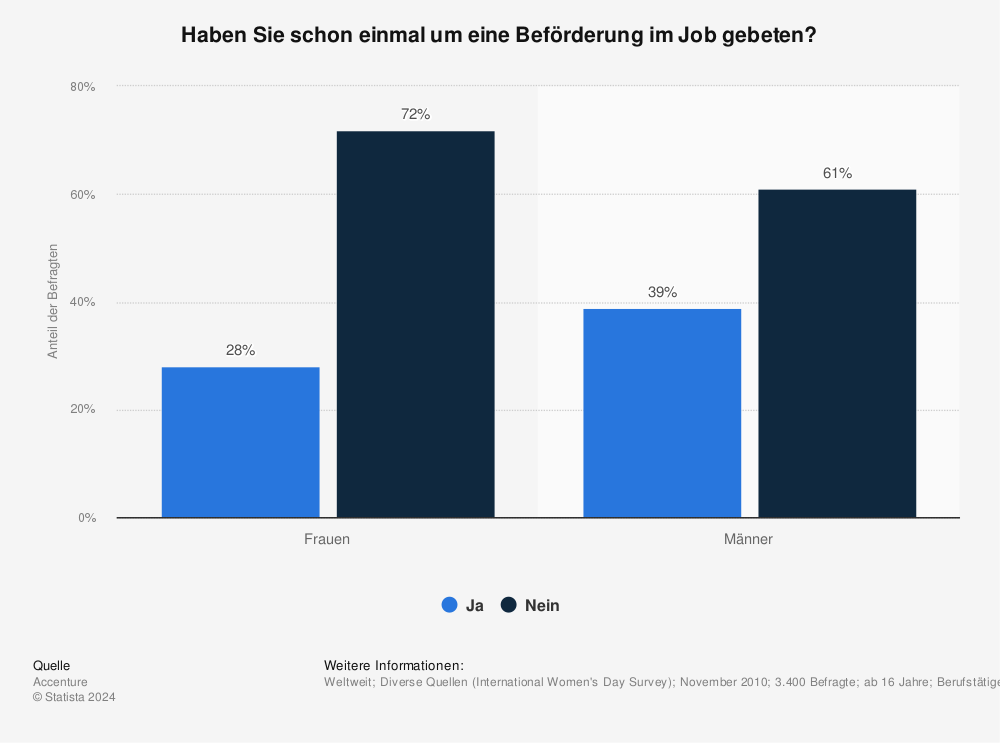

After a look at the question of who has ever asked for a pay rise, here is a look at career goals, or the active approach after a career advancement. The survey of the Federal Statistical Office asked the following question: “Have you ever asked for a promotion on the job?

You can find more statistics at Statista

In audio book episode 56: Increase income and increase creative time according to Pareto, Alex Fischer gives good tips for those who are not yet self-employed or have their own business. Central is the big question: “Where does my salary actually come from?” A real thought-provoking impulse for those employees who so far think that they are “only” paid by the hour. A fallacy, because in the end you will be paid by results as an employee. Like in physics:

performance = work / time

You want to increase your value in the company? Listen to Equation 56: Increase income and creative time according to Pareto.

For you to bring the best added value, you need to know 1) what your goal is 2) what you can do 3) who you know and 4) for whom your setting of goals, strengths and resources is most valuable. Another learning from Alex Fischer that I want to show you in short form. Altogether the following section consists of 5 episodes of the audio book:

Find goals, resources, strengths, industries & match

Every single episode contains many tips, what I want to give you here is just a small, little insight with strong learnings from the beginning of part 3 of “Richer than the Geissens” by Alex Fischer. The next episodes are all about being clear about your own goals (which you have already learned in the first two parts).

According to Alex Fischer, you will need a detailed resource list for this, supplemented by a detailed list of your strengths and a sector market directory. Summarized once again, the next episodes will be about:

- Purpose-list

- Resource list

- Strength list

- Industry market niche directory

4 steps and 4 lists

Since you already know your Purprose (listen to episode 16. How to find your Purpose) or at least the technique you can use to find your Purpose, the review continues with episode 58. Basically resource planning is important so that you know your own assets. Simply put: Who do you know ? What can you organize (through your contacts)? If you want to find out what your resources are, listen to Episode 58: Your resource list.

Now follow your strengths, how you identified them and how long such a list can be (spoilers, Alex Fischer had 5 pages at the end), the more precisely you can estimate the added value you can bring to customers in the analysis. Find your strengths and categorize them, and learn how to do this in Following 59: Your list of strengths. With the knowledge of your purpose, your resources and your strengths, you go to the last step, the matching of these assets with the industry market niche directory. Where you get the The Business Market Niche List and how to find your market niche is explained in Order 60: The Business Market Niche List.

Match: Your market niche

The big goal in the process:

“Know your market!” – Alex Fischer

Find your place that will guarantee you cash flow, because you need equity for your first property. Through the targeted processing of the 4 lists, the subsequent assessment of individual areas and their evaluation, you will find the “gap” that makes you successful.

It does not always have to be a world changing idea, like the iPhone. For example, the hairdresser could keep his ears open and cooperate with a broker. If one of his numerous customers wants to sell a condominium, a house or even an apartment building, he or she would receive a lot of commission as a tipster without having to invest significant additional work.

Another example on the subject of resource planning and “Strengthen Your Strengths” by Alex Fischer: Even for unemployed people there are opportunities to build up passive cash flow independently and to create their own profitable company in order to generate equity capital. On the other hand, an unemployed person, who supposedly has not always been lucky in life, has very good contacts to other unemployed people through unemployment. That means he or she has know-how of forms, procedures, dates, measures, etc. Additionally, he or she knows some or even many other unemployed people. Wouldn’t this be the chance to build your own machine (keyword: digital information products)?

The more points you find, the more new points you will come up with as strengths and resources! Organize your assets and find your market niche in Order 60: The industry market niche list.

Everything else and much, much more you can hear in the podcast!

Earn money with real estate

Now 15 more extremely interesting and informative episodes follow. Your first equity, the increase of cash flow to your first property and much more! For example, in the coming episodes you will learn the answer to the question: How does real estate work as an investment tool?

But before that you will get some good best practice examples from Alex Fischer’s environment: From the automation of information products to the use of roof space in the real estate sector, advertising space, shared room rental through apartment sharing and permitted subletting in the rental contract, there is fact after fact and story after story. This is followed by much more from Event 61: Increase cash flow.

Universal, timeless recipe for success

The podcast contains so many universal and timeless recipes for success! It’s best to take notes while listening to the podcast. Here’s a very memorable quote from Alex Fischer from these episodes that I made a note of:

“Strengthen your strengths!” – Alex Fischer

Here I want to point out once again the universality of the audio book “Richer than the Geissens”. For private persons, employees but also entrepreneurs who already generate a good cash flow, the book and audio book is a strong and (for the topic) compact guide.

Alex Fischer: Richer than the Geissens

“In 5 years without equity to become a real estate millionaire” – here you get the right and important tools for a happier and more fulfilled life, also through financial freedom. Alex Fischer is living it, with real estate he has already provided for himself for a long time. His focus is on passing on knowledge, strategies and success stories. An extremely inspiring audio book. You want more Know How? Become a free member of the Alex Fischer Community.

Alex Fischer: Learn more strategies

If you want to learn more about principles, strategies and methods, you should take a look at Alex Fischer’s YouTube channel. Here you can find playlists sorted by topic to learn everything online. In addition, you can find links to slides and checklists here on YouTube – these documents are also completely free, without an email address. Tip! In the free member area you get the 27 strategies that Alex Fischer has extracted after over twenty years of experience, compressed in an 11-page PDF as a checklist.

- Alex Fischer – Website & free members area

- Alex Fischer Youtube

“Richer than the Geissens”: Book and audio book

With over 200,000 readers, “Richer than the Geissens” is mega successful, for good reason. It is also in the top 100 at Amazon! In a nutshell, you get 43 timeless laws of success with which you can become more successful financially, professionally and privately. You learn to reach your goals, to “materialize” them (what this means, you learn in the book). You will receive exact step-by-step instructions for your own personal financial freedom. This way you avoid really frustrating mistakes right at the beginning. As a private person and/or as an entrepreneur, you learn from Alex Fischer how to avoid these fatal mistakes and at the same time follow your passion – every day! The book contains hundreds of learnings that will help you to live a happier and more fulfilled life. Best of all, you can get the audio book for free on Spotify and iTunes!