Investment Private Lending: Cost and Provider Comparison

Where is the best place to take out a loan? Maybe you should think about a personal loan. This is a very sensible form of financing for equity capital.

Back to the Capital Investment editorial.

Risk assessment personal loan: advantages and disadvantages

What are the advantages of a personal loan from my bank? Can I get the loan without SCHUFA? There are many questions, we have the first important answers. For all other questions, it is best to contact your bank advisor or a reputable comparison portal for loans.

Questions about the personal loan

- What are the advantages of a personal loan from my bank?

- Is a given personal loan earmarked for a specific purpose?

- Is a prior credit check obligatory in Germany?

- Can you take out a personal loan without a SCHUFA query?

- What loan amounts are possible with a personal loan?

- Is a personal loan cheaper than dealer financing?

- What are the requirements for a personal loan?

- Can a loan be tax deductible?

Risk assessment

Personal lending is available through various lending portals. The current return of Privat-Kreditvergabe is medium and the risk of Privat-Kreditvergabe is therefore not high. Private lending allows for easy participation opportunities through various lending portals. Of course, there are also disadvantages in the private lending, because when taking detailed information about the providers are necessary to avoid mistakes.

Advantage

- Easy participation via credit brokerage portals

Disadvantages

- Detailed supplier information should be obtained in advance

Application procedure

Applying for a personal loan from the bank is fairly quick if you have a good credit rating.

- Determine credit amount and term

- Fill out credit application online

- Sign a credit agreement

- Obtain credit

Comparison

| Provider | Auxmoney | Giromatch |

|---|---|---|

| Loan amount | 1,000 € to 50,000 € | up to 25.000 € |

| Terms | 12 to 84 months | 12 to 60 Months |

| Partner bank | SWK | Fidor |

Sources: Auxmoney, Giromatch (as of November 2018) via IHV: Personal Loan

Costs

| Provider | Auxmoney | Giromatch |

|---|---|---|

| Effective interest | 3.2 % to 19.95 | 2.9 % to 6.9 % |

| Commission | 2.95 % of the loan amount | 12 months term: 0.1 % to 0.5 % one-off of the net loan amount / 24 months: 0.25 % to 1.25 % one-time /36 months: 0.4 % up to 1,75 % / 48 months: 0.55 % to 2 % one-time / 60 months: 0.7 % to 2.25 % once¹ |

| other fees | 2,50 € monthly as service fee | no fees for own personal loan / fees possible if the customer is referred to a third party |

depending on creditworthiness and term

Sources: Auxmoney, Giromatch (as of November 2018).

Statistics

Instalment credit agreements concluded in Germany

Number of new instalment loan contracts concluded in Germany from 2006 to 2018 (in 1,000)

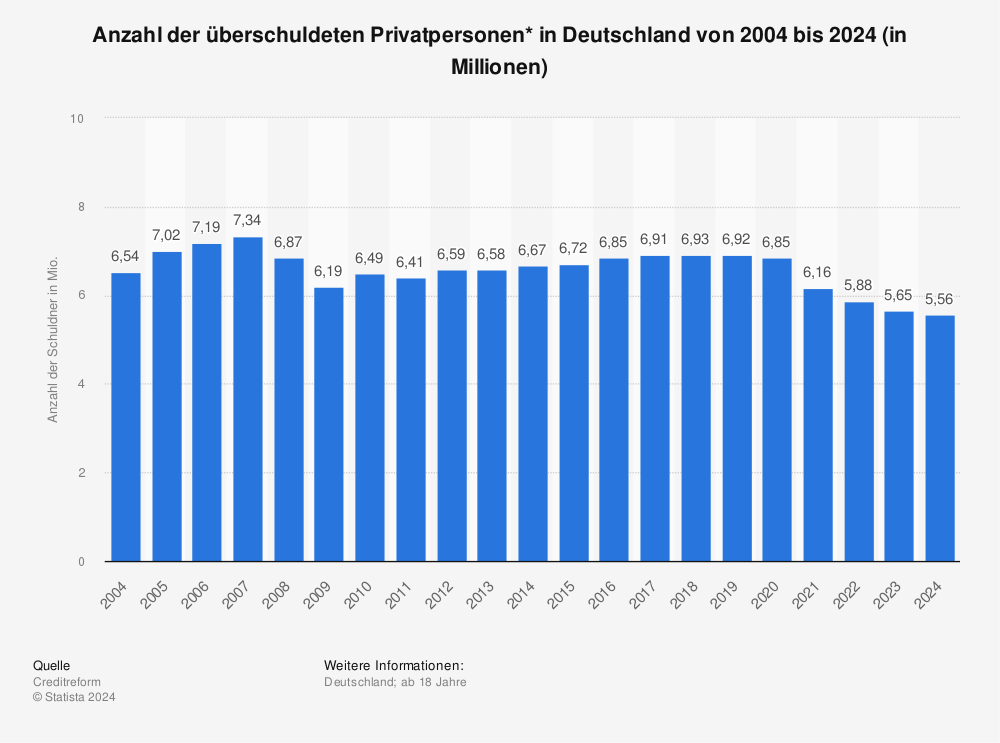

Over-indebted private households

Number of over-indebted private individuals* in Germany from 2004 to 2019(in millions)