Asset managers: Does private asset management make sense?

Wealth management – Wealth managers help their clients navigate the complex and increasingly digital financial world. Through discussion and trust, the client’s financial situation is analysed in detail, so trust is central to the work we do together. Your personal current circumstances and long-term goals are taken into account during the planning process. In the end, there is a detailed, personal wealth plan, individually developed for the client. A well-founded and high-yield asset management is possible for financially strong investors as well as for small savers. More about costs and minimum investment amounts later.

Back to investment.

Does an investment advisor make sense?

Finding the right asset manager is not that easy. A test would be expensive. It makes sense to leave the management of your finances to professionals. Accordingly, the search to find a good asset manager is meticulous. Especially in cities that are flourishing economically, such as Hamburg, Berlin, Munich, Cologne, Düsseldorf, but also cities like Frankfurt and Stuttgart. Experience has not yet been made in the first search, so it is all the more important to inform yourself about private asset management. We have everything important on the subject for you.

At what point is asset management worthwhile?

The big question is: at what point does asset management pay off? Banks offer standardized products for assets starting at 50,000 euros. Online, there are even much lower models.

Standardised banking products from 50,000 euros

An individual and personal asset management, which is accordingly profitable, only pays off from a minimum investment sum of 500,000 euros.

Personal investment advice from 500,000 euros

Independent investment advisors

Independent investment advisors help with financial advice and brokerage. But what does an investment advisor do, what are the costs for you as an investor and how does the profession differ from the classic bank advisor in the bank branch?

Advantages

- Professional asset management – through experience you have a better risk-return ratio

- Neutral assessment of your financial situation and emotion-free action of the asset manager

- Regular reports create transparency about your current total assets

- You save a lot of time compared to your own private asset management.

Disadvantages

- Asset management costs, which include fixed costs, performance fees and investment costs

- No flexible capital access and limited control over your fixed assets

- Risk, for example if incorrect decisions are made by the portfolio manager or in the event of conflicts arising from the contractual relationship.

Consultation

As described, they help private clients and companies to find the right financial products to increase their own wealth.

- Wealth creation

- Construction financing (Tip: Capital investment real estate)

- Banking

- Retirement provision (Tip: Investment life insurance)

- Insurances

- Government grants

Wealth creation

In the advisory meeting, the focus is then on topics such as individual asset accumulation. In addition, especially in times of “housing gold”, advice is given in the area of construction financing.

Real estate and construction financing

How can capital be invested sensibly? Should you buy a house, a condominium or a plot of land in an attractive inner-city location? In cities like London, even parking spaces are now being sold like luxury real estate. One pays up to 450.000 Euros for a simple parking place without a roof. With this amount you could also buy 2 homes in London suburbs. Flat, house, plot or even alternative models from car park to holiday resort. So to get a stable and good return on investment with property, advice is essential.

- Read more about real estate as an investment here.

Tip! If you are looking for an exclusive property, you don’t need a normal estate agent but a luxury estate agent with specific knowledge and a good network. Many of these properties will also never appear in the usual real estate portals.

Retirement provision and insurance

There are many options when it comes to retirement planning. But in addition to the real estate just mentioned, the conversation is also about basics. The most important thing to start with is life insurance. If you are focusing on asset accumulation, you will specifically need a capital-forming life insurance policy.

How does life insurance work? Life insurance can basically be divided into two types, term life insurance and endowment life insurance. Life insurance stands out above all as the best protection for partners and children (term life insurance). But they can do even more, for example accumulate assets for old age (endowment life insurance). With an endowment life insurance you can protect yourself or save money for old age, keyword retirement provision. A life insurance policy with a savings effect does both at the same time, is relatively inexpensive and yields a return.

- Read more about life insurancehere

In addition, there are many other topics that are discussed to create the perfect portfolio of value investments. For example, it is about tax advantages that arise from value investments. Did you know – increases in the value of precious metals and gemstones are tax-free, as is the purchase of investment gold. Read more on the subject here: Investment jewellery. Already knew, from experience this investment mix is recommended:

- 1/3 Fixed-interest investments / securities

- 1/3 Real estate

- 1/3 mobile tangible assets, e.g. diamonds or art

Recommendations for financial products

Based on the advice given, independent asset managers recommend the right products for a stable and profitable mix of banking, insurance and building society options.

What is the difference between investment advisors and bank advisors?

Bank advisors are experts in their field. However, they also limit themselves to advising on their own preferred products.

Asset managers, on the other hand, combine experience and expertise in various financial sectors. This includes classic but also modern approaches as well as a broad portfolio of financial products.

Wealth managers are therefore experts in the following areas, among others:

- Economics and business administration

- Law and taxes

- Insurance products for private households and companies

- Banking products for private households and companies

- Building savings and real estate

- Customer service and work organization

- Financial planning

Financial planning

The be-all and end-all for private asset managers is close cooperation with the client. The end result is a concrete financial plan. In order to be able to draw up the financial plan, he or she must obtain information from the client. This includes two parameters in particular:

- What’s your income?

- What expenses do you have, do you have planned?

- Your long-term goals

Accordingly, a great deal of trust must be placed in the independent asset manager. After the asset manager has gained an overview of the client’s financial situation, the long-term goals are also asked about in the consultation. Because it is about a long-term, common and profitable cooperation for both sides, you as investor and the asset management. The elaborated financial planning now offers a needs-based and individual solution for your current and future plans.

Asset management costs

How much does an asset manager cost?

Fixed costs

As a rule, the costs or fees of asset management, measured against your investment amount, are a maximum of 1.5% per year. Individual companies and independent managers also take up to 2.5%, above which it should not go in any case. Standardised or automated asset management is often cheaper.

Success fees

Success fees? You’re supposed to pay extra, too? Yes! Because success fees are at the same time a strong incentive for the asset manager to work as successfully as possible.

Many asset managers additionally charge a performance fee anyway. The amount of this commission is measured, for example, by the percentage of the value growth achieved.

Cost of investments

In addition, costs are charged that are directly related to your investment objects. These are, for example, custody fees, transaction fees and account management fees.

Tasks summarized

- Helping clients – Wealth managers help their clients navigate the complex and increasingly digital financial world

- Financial analysis – Through discussion and trust, the financial situation of the client is analysed in detail.

- Goal setting – your personal, long-term goals are taken into account in the planning process

- Government funding – you help current, government funding opportunities to best use

- Financial planning – At the end there is a detailed, personal wealth planning, individually developed for the client.

How do I find a reputable asset manager?

Our checklist for the right asset management:

- Investment amount – Is your investment amount high enough? (see “When is asset management worthwhile [above]; standardised from 50,000 euros, personal from 500,000 euros)

- Professional Qualifications – To find a good manager, check the professional qualifications of your portfolio manager, then make a decision based on your personal assessment after the initial interview.

- Make sure that the costs or fees do not exceed 1.5% per year in relation to the investment amount.

When it comes to asset management, you should think long-term and invest accordingly. As an investor, you should have patience and confidence, but also a long-term investment horizon in mind.

With an asset manager you do not operate an investment for a few weeks or months. As you can see from the costs, the fees are already calculated on the basis of the annual investment amount. Financial products, whether insurance or construction financing, are planned for the long term. In the short term, returns on your investment are rather random and unpredictable. This is because many products are subject to normal economic conditions. This means that emotions in the stock market also play a role. Tip.

- Read more about stocks as investments, bonds and funds (ETF) here.

If you want to achieve attractive returns in the long term and thus preserve and increase your assets, you have to accept such temporary price fluctuations; what is important is the long-term perspective. Here it is also worth taking a look at precious metals, or the performance of gold, silver, platinum or palladium. With all precious metals you can see (similar to the real estate sector) that long-term returns are almost always achieved. The longer, the higher.

Did you already know? Dividends on shares also rise and rise. Dividend means: If you hold shares for a longer period of time, you will receive dividends at the end of the financial year, if the company is successful. As we show in our article on shares, profits have risen by a staggering 271.1 % in the last 15 years alone, from just over 10 billion euros in 2004 to over 38 billion in the meantime, for German DAX companies alone.

271.1 % Increase in dividends in 15 years

This is the development of the dividend payments of the DAX companies in the years from 2003 to 2019 (in billions of euros).

- 2003: 10.3 billion

- 2005: 15.2 billion

- 2007: 23.5 billion

- 2009: 22.1 billion

- 2011: 26.0 billion

- 2013: 28.0 billion

- 2015: 30.1 billion

- 2017: 32.1 billion

- 2019: 38.6 billion

Current investments: The most popular investments

Which of the following investments are currently the most popular? These statistics from the Federal Office represent the results of a survey of over 1,000 respondents on the various preferred forms of investment in Germany. At the time of the survey, “about 27 percent of respondents owned life insurance. In 2011, around 40 percent of those surveyed still stated that they had taken out a life insurance policy for old-age provision.”

13% less life insurance in 8 years

You can find more information about the statistics on Statista

| 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | |

|---|---|---|---|---|---|---|---|---|---|

| Real Estate | 28% | 31% | 27% | 27% | 27% | 29% | 28% | 29% | 30% |

| a building savings contract or building savings plan | 28% | 26% | 28% | 31% | 32% | 32% | 29% | 33% | 33% |

| a life insurance policy | 27% | 30% | 30% | 31% | 34% | 35% | 32% | 38% | 40% |

| an overnight account | 24% | 25% | 22% | 23% | 32% | 29% | 27% | 29% | 33% |

| Fund shares | 24% | 20% | 17% | 18% | 23% | 20% | 21% | 23% | 25% |

| Shares | 15% | 15% | 13% | 13% | 15% | 12% | 13% | 15% | 16% |

| Time deposit or term money | 13% | 13% | 14% | 12% | 19% | 17% | 21% | 20% | 21% |

| net: gold/silver | 13% | 12% | 8% | 7% | 11% | 8% | 7% | 11% | 8% |

| gold bars or coins | 11% | 10% | 7% | 6% | 9% | 7% | 6% | 9% | 6% |

| Antiques, such as a very old cupboard*. | 6% | 8% | 4% | 5% | 7% | 6% | 5% | – | – |

| Objects of art, such as paintings*. | 4% | 4% | 3% | 3% | 5% | 4% | 4% | – | – |

| silver bars or coins | 4% | 6% | 3% | 2% | 5% | 4% | 3% | 6% | 4% |

| Bonds* | 4% | 3% | 2% | 3% | 4% | 2% | 3% | – | – |

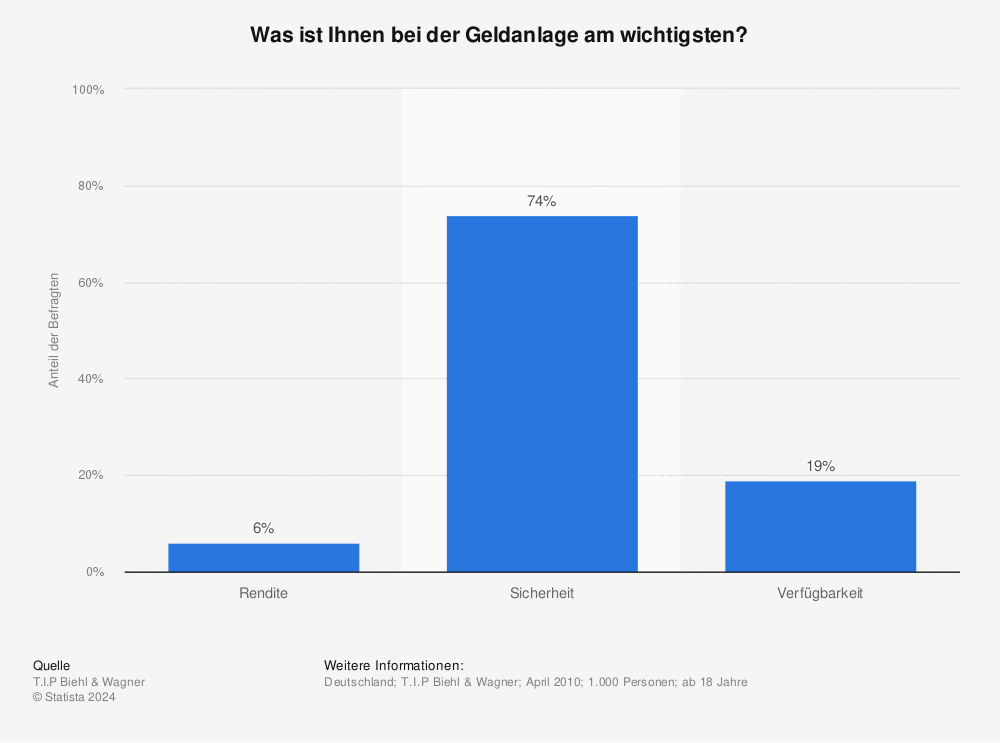

Return or risk?

What is most important to investors when it comes to investing in value?

Source: Statista

Source: Statista

The ten largest institutional providers

In 2017, Blackrock and Vanguard Group were the two largest asset managers in the institutional space.

| Place | asset manager | Country | Total assets (in USD billion) |

|---|---|---|---|

| 1 | BlackRock | USA | 6.288 |

| 2 | Vanguard Group | USA | 4.940 |

| 3 | State Street Global | USA | 2.782 |

| 4 | Fidelity Investments | USA | 2.449 |

| 5 | Allianz Group | Germany | 2.358 |

| 6 | J.P. Morgan Chase | USA | 2.034 |

| 7 | Bank of New York Mellon | USA | 1.893 |

| 8 | capital group | France | 1.778 |

| 9 | AXA Group | USA | 1.731 |

| 10 | AMUNDI | USA | 1.709 |

Source: Willis Towers Watson

The ten largest private providers

When it comes to private providers, Swiss banks have traditionally been strongly represented. In 2018, for example, the Swiss bank UBS again topped the list of the largest private asset managers.

| Place | asset manager | Country | Total assets (in USD billion) |

|---|---|---|---|

| 1 | UBS | Switzerland | 2.404 |

| 2 | Morgan Stanley | USA | 1.972 |

| 3 | Bank of America | USA | 1.950 |

| 4 | Wells Fargo | USA | 922 |

| 5 | RBC | Canada | 791 |

| 6 | Credit Suisse | Switzerland | 719 |

| 7 | Citi | USA | 452 |

| 8 | J.P. Morgan Chase | USA | 435 |

| 9 | Goldman Sachs | USA | 413 |

| 10 | BNP Paribas | France | 362 |

Source: Scorpio Partnership

Statistics and numbers

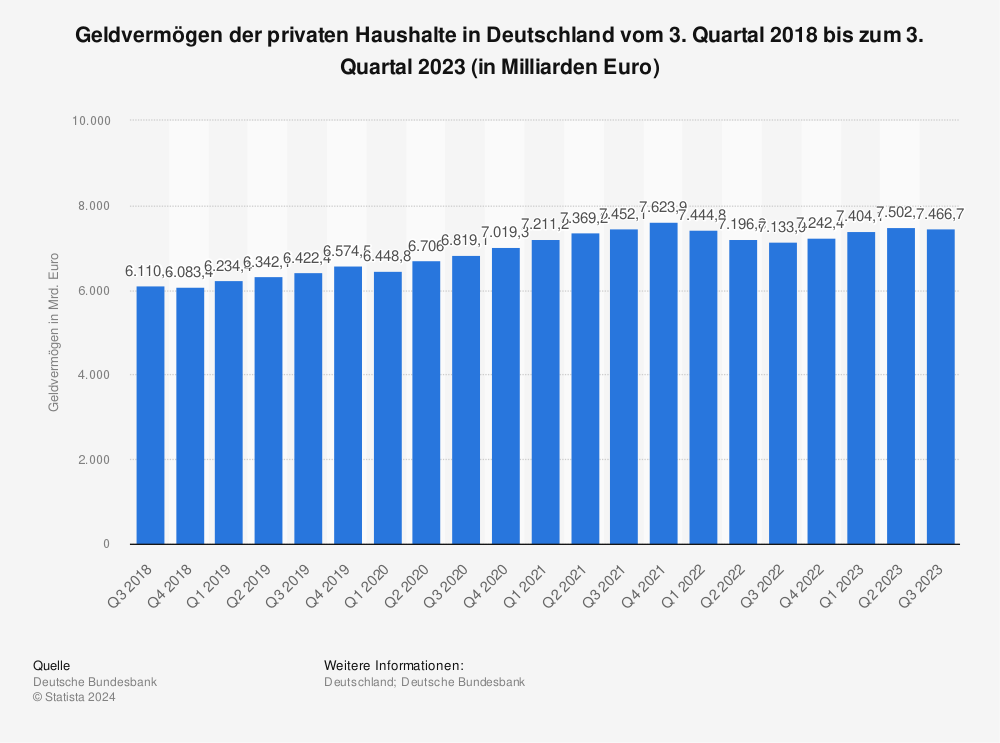

Financial assets: Germany

Financial assets of private households in Germany from Q2 2014 to Q2 2019 (in billions of euros).

Source: Statista

Source: Statista

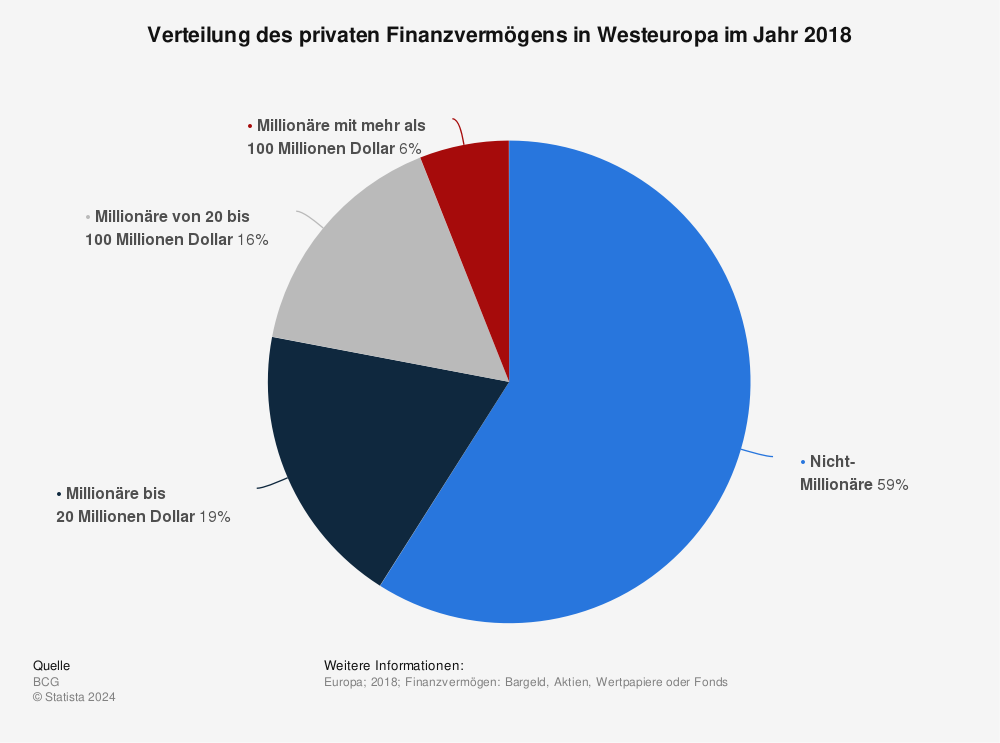

Financial assets: Western Europe

Distribution of private financial wealth in Western Europe in 2018.

Source: Statista

Source: Statista

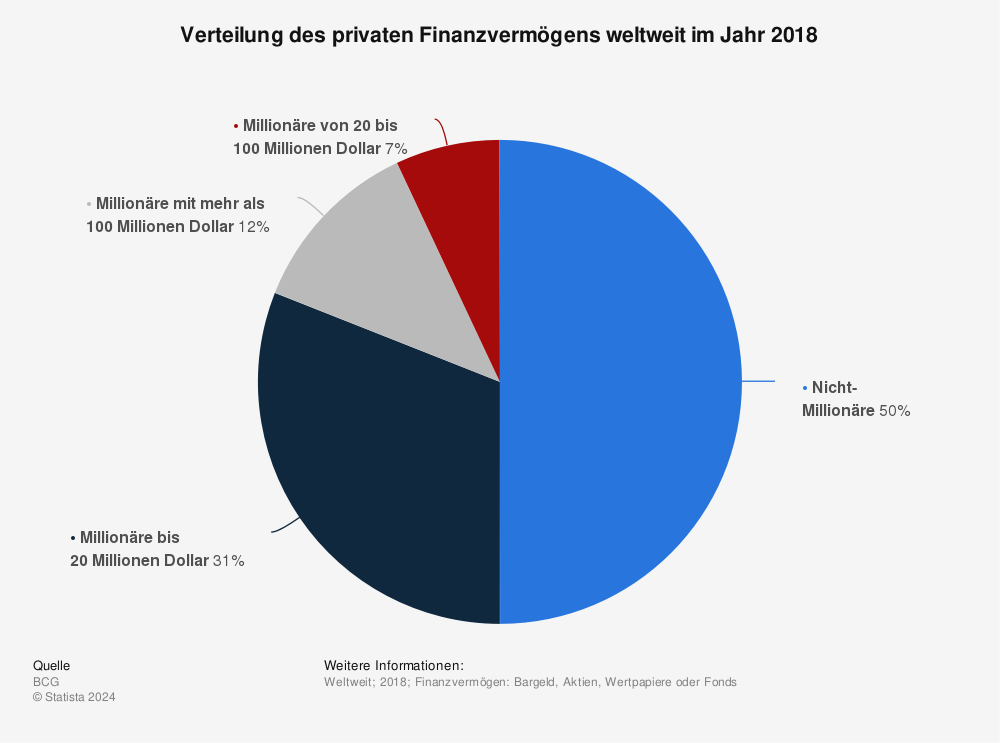

Financial assets: Worldwide

Distribution of private financial wealth worldwide in 2018.

Source: Statista

Source: Statista