Investment funds: Time-linked index purchase + ETF

Funds as an investment are particularly suitable for investors who do not want to deal with the news on a daily basis. The success of individual shares depends heavily on day-to-day business. So-called funds combine various securities into a bundled investment portfolio. Shares are generally regarded as risky and speculative. But there are also differences in trading securities. For example, active investors with individual securities and cautious investors (passive) who focus on ETF (index funds such as DAX, NASDAQ & Co.). Today we take a look at the topic of funds as an investment. We highlight advantages, disadvantages and risks, but also take a look at the types of traders and facts and figures about equity funds. You have capital to play with? Then check out our article on stocks here as well. Now we start with funds, the definition, their advantages and disadvantages?

Back to the Capital Investment editorial.

Equity funds: advantages, disadvantages and risk

If you want to play it safe, you should invest in funds. Before buying, however, there are many questions to be answered.

- What is an ETF simply explained?

- What kind of funds are there?

- What are transaction costs for funds?

- What are the ongoing charges with a fund?

- How stable is the performance?

- What are the costs of an ETF savings plan?

- What are the best ETFs? – more on this at the end, with the top 3 funds

Facts about funds

The most important 3 facts about funds as an investment:

- Binding term (earlier exit associated with losses)

- Minimized risk through bundled individual stocks

- Purchase fees must be taken into account in the volume

For those who can put money aside, funds are an excellent alternative to individual stocks. Bundled funds are less sensitive because they contain many players that are more stable in the aggregate. The returns are accordingly more moderate than with shares, but as you can quickly see in our best practice of dividends, the investment is worthwhile. In the last 15 years alone, dividends have tripled, from 2004 to 2019, which is 15 years, brought an additional payout of 27.8 billion euros annually. An increase of 271.15% on the comparable year.

What is an ETF simply explained?

ETFs are pooled stocks, so risk (default, profit and loss spikes) goes down. The nuts and bolts of the trade-off. ETFs are associated with fixed maturities.

Maturity of ETF securities

If you are familiar with the classic account model, you can compare shares and funds with overnight money and fixed-term deposits. Call money is always available, there is no capital commitment. If you have opted for a time deposit model, your money is parked with a certain term. During this time you have no access to your capital. If you need it prematurely, you will incur losses.

So here you are weighing up, is it money that you may need or can you put your capital aside and tie it up for a period of time.

Let’s start with our usual assessment: advantages, disadvantages and risks of trading with funds.

Funds at a glance

Funds can be set up just like shares at any bank. Different investment portfolios are possible and so a corresponding gradation is possible according to the risk appetite of the individual investor. Of course, everyone knows the tax advantages that are possible with capital transactions. Due to the large selection of fund products, you can spread the risk well.

Each purchase and fund management costs fees. Your capital is tied up for the long term, and liquidation is only possible at a loss before the end of the term.

The current return of funds is medium (compared to the investment alternatives) and the risk of funds is absolutely manageable.

Advantages

- Simple deposit facility with banks

- Adaptation to your own risk appetite: different portfolio types are possible

- Tax benefits

Disadvantages

- Long-term capital commitment

- Dissolution only possible with loss

- Custody fees

Buy funds? Definitions and tips

Before buying your first securities, you should check which type of investment you are. Basically, you have two options.

- Passive investor (ETF, index fund)

- Active investor (share)

Passive (ETF) or active investor (stock)?

Both forms offer advantages. Trading individual stocks provides for higher price breakouts, thus potentially more profit (and loss). The risk increases. If you want to trade more cautiously, you can buy index funds (ETFs).

Passive investor

The word ETF portfolio stands for “Exchange Traded Fund” and is an exchange-traded index fund. This index fund tracks the performance of an index, such as the DAX in Germany or the NASDAQ in the USA. But these are only the best known representatives. As you will see in the list of the best, biggest and cheapest funds.

New York Stock Exchange

At their core, ETFs combine the advantages of stocks and funds into one product, so you can invest money directly in entire markets through ETFs. A real advantage.

Active investor

In contrast to funds with manageable risk, you can also act as an active investor in trading. As an active investor, you invest in individual stocks. This costs time, because it is about analyzing individual companies to determine which paper you want to buy.

As an active investor, you will be affected more quickly by price fluctuations. Even one piece of bad news in the morning about a single company can greatly minimize your capital if you don’t diversify.

Source: IhrHausverkauf.de(Buy Stock)

List: Best, Great, and Cheap ETFs (Index Funds).

As of: 12/31/2019

Best MSCI World ETF by 1-year fund return

| 1 | ComStage MSCI World UCITS ETF | 32,25% |

| 2 | Xtrackers MSCI World Index Swap UCITS ETF 1C | 31,27% |

| 3 | Deka MSCI World UCITS ETF | 31,16% |

Largest MSCI World ETF by fund volume in EUR

| 1 | iShares Core MSCI World UCITS ETF USD (Acc) | 20.904 million |

| 2 | iShares MSCI World UCITS ETF (Dist) | 5.269 million |

| 3 | Xtrackers MSCI World Index UCITS ETF 1C | 4.820 million |

Cheap MSCI World ETF by Total Expense Ratio

| 1 | Lyxor Core MSCI World (DR) UCITS ETF | 0.12% p.a. |

| 2 | SPDR MSCI World UCITS ETF | 0.12% p.a. |

| 3 | HSBC MSCI WORLD UCITS ETF | 0.15% p.a. |

Source: JustETF.com

How much does it cost to buy ETFs?

If you are interested in buying an ETF, you will find many different pricing models on the internet. Here, the individual prices per trade depend on the online broker. The standard fees are usually five to eight, maximum ten euros. In addition, there is a fee of 0.25% depending on the trade amount. The fee per purchase is typically limited to an upper maximum amount.

If you are online a lot, you will quickly find alternatives. For example, flat-fee offers from various established discount brokers such as onvista are attractive.

Equally interesting are promotional offers, where at certain times the volume-dependent fee or the entire fee is waived completely.

Fees and costs for ETF purchase summarized:

- Purchase fee of 5 – 8 Euro, maximum 10 Euro

- Trading amount mostly 0.25 % of purchase

- Tip. Flat-free offer like at onvista

Your first ETF purchase: invest a lot or a little?

Another unbeatable advantage of fund trading is that you can start with small investment amounts. While you have to present 10% – 20% equity capital to the bank when investing in real estate, which can quickly be 50,000 – 100,000 euros in major cities such as Hamburg, Berlin, Munich and Cologne. The entry into equity funds is often profitable with only 10% of the buzzer, about 5,000 – 10,000 euros per package.

Order quantity and purchase fee

Why shouldn’t you buy smaller packages? There is an order fee for every trade. If you buy a package for 100 euros, many banks directly 5-8 euros order fee. Accordingly, your portfolio shrinks directly to 92-95 euros in value. This means that you have already made the first 5-8 euros loss, which must first be compensated for by a corresponding increase in the price of the fund. This means a 5% – 8% loss in value directly at the time of purchase.

Purchase of 100 Euro Ø 6.5% loss

plus 0.25% trading fee

If you buy a package of 1,000 euros, the trading fee of our exemplary 5-8 euros is much less important. With a purchase of 1,000 euros, you retain 992-995 euros in value. Accordingly, the loss in value is reduced to only 0.5% – 0.8%.

Purchase of 1.000 Euro Ø 0.65% loss

plus 0.25% trading fee

With a package of 10,000 euros and an order fee of 5-8 euros, the loss in value is directly reduced to 0.05% – 0.08%.

Purchase of 10.000 Euro Ø 0.07% loss

plus 0.25% trading fee

That’s why it’s worth buying larger packages directly.

In addition, there is the aforementioned purchase fee of approximately 0.25% of the traded package.

Of course, the management fee for your portfolio is just as favourable. The more value you hold, the smaller the effect on your portfolio.

Selling funds: Sales Opportunities

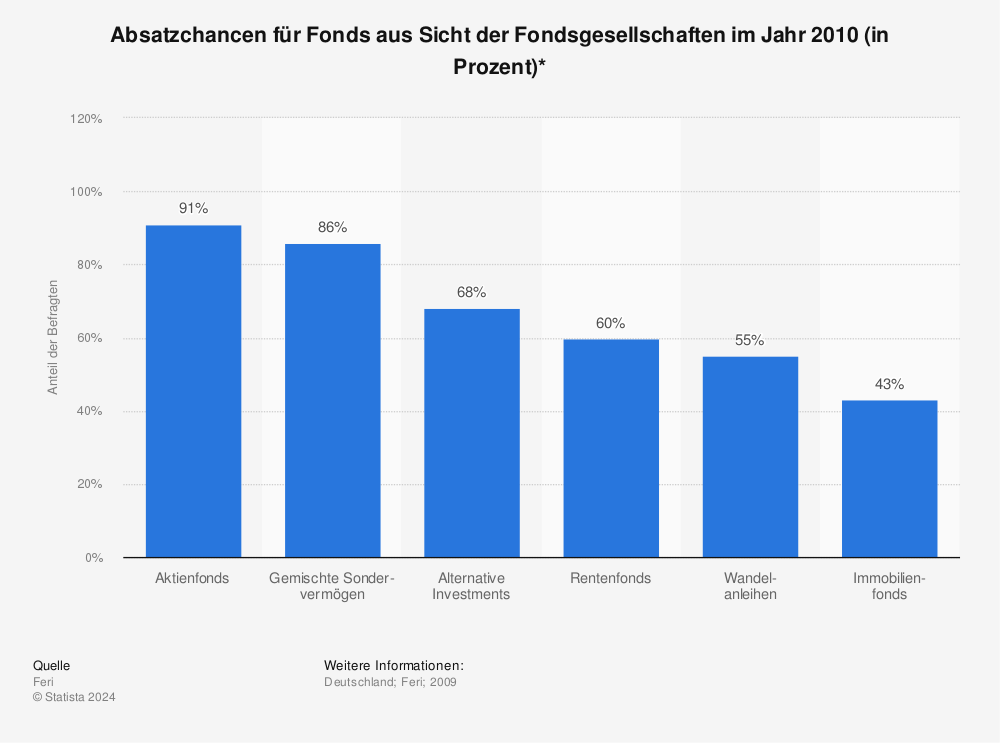

This survey shows the expectations about the sales opportunities for funds from the perspective of the fund companies. Sales opportunities for funds from the perspective of fund companies in 2010 (in percent).

Find the best sales according to experts:

- Equity funds

- Mixed investment funds

- Alternative investments

- Pension funds

- Convertible bonds

- Real Estate Funds

Source: Statista