Investment life insurance: risk & asset accumulation

Investment life insurance – life insurance can be divided basically into two types, the term life insurance and the capital-forming life insurance. Life insurance stands out above all as the best protection for partners and children (term life insurance). But they can do even more, for example, build up assets for old age (endowment life insurance).

Life insurance: Explanation

We’ll answer your questions:

- How does life insurance work?

- How useful is life insurance?

- Can you cash out your life insurance?

- What is the difference between term life insurance and endowment insurance?

For whom does life insurance make sense? By taking out a life insurance policy, you as a saver are not only providing for your own old age, you are also providing financial security for your family.

For whom does life insurance make sense?

Depending on the personal family and occupational status, different life insurance policies come into question.

- Young families – term life insurance if the main earner fails is provided for all

- Self-employed – endowment and term life insurance for family and any outstanding loans (company, property, etc.)

- Employee – endowment insurance with the advantage of asset accumulation (as a supplement to the later pension)

Private risk protection is indispensable for everyone who does not go through life completely alone. If you have children, a spouse or other close relatives, life insurance can provide protection. Even if you’re building a home or starting a business, you should make sure your loved ones are taken care of if the worst happens.

Why does this make sense? If you should die, your relatives can, for example, pay off the loan for the house or the children’s education can continue to be financed.

Advantages

- Capital Security

- Protection for surviving dependants in the event of death

- Asset accumulation (for endowment insurance)

The cost of the insurance you take out depends on your individual objective for cover and on the agreed term.

Tip! Due to the current low-interest phase, a unit-linked life insurance policy is recommended.

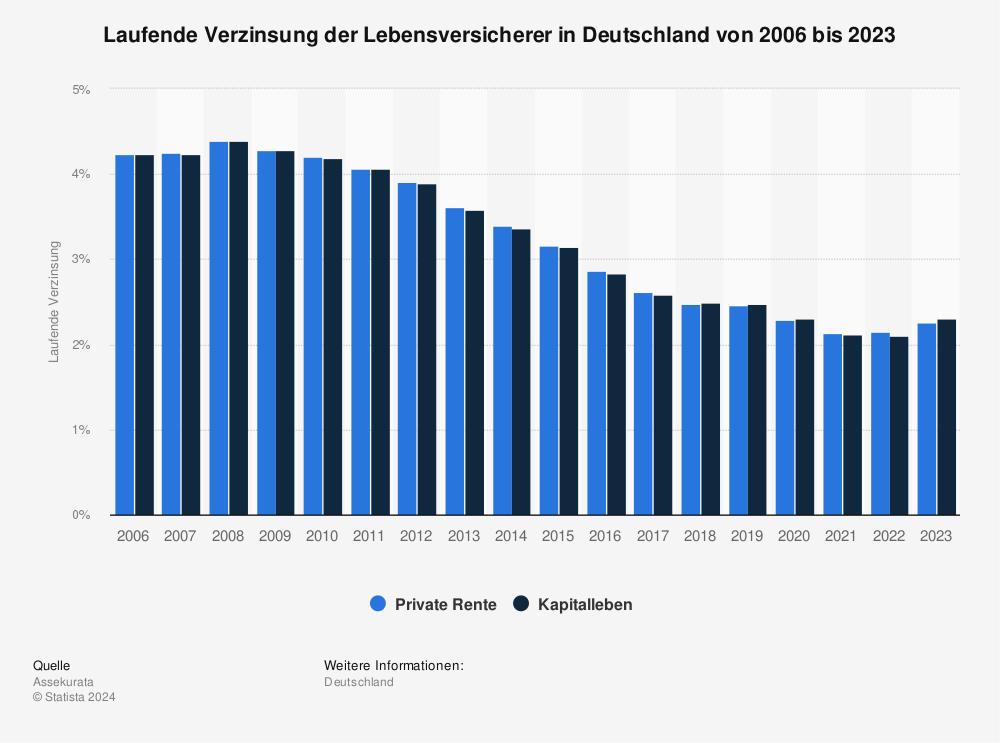

Interest rate development of life insurers

Here you can see the current interest rate of life insurers in Germany from 2000 to 2019.

Source: Statista

Let’s take a closer look at the key differences between the two types: Term and endowment life insurance.

Endowment life insurance: protection and asset accumulation

If you should reach a high age, you can save for later at the same time with a capital-forming life insurance.

With an endowment policy you can protect yourself or save money for old age, keyword retirement provision. A life insurance policy with a savings effect does both at the same time, is relatively inexpensive and yields a return.

It is ideal for you if you want to protect your surviving dependents or you want to build up assets for your old age. In addition, there are tax benefits for the life insurance but also some interest (albeit low for current new contracts).

- Endowment insurance is protection for surviving dependants

- It builds up assets for your old age (later payout)

- Costs: On average from 50 euros a month (600 euros a year).

Term life insurance: protection also for loans

With term life insurance, you can protect your loved ones above all. Term life insurance protects your next of kin financially in the event of your death. The conditions are affordable for everyone and are available on average from providers for as little as 2.30 euros – 2.85 euros / month.

Term life insurance is perfect for you if you want your survivors to be fully covered (example: purchased house, remaining debt must be paid in order not to lose the house). Tip. The term life insurance does not only cover the credit of a real estate, all credits and loans are secured by it.

- Costs: On average from around 2.50 euros a month (30 euros a year) with 100,000 euros sum insured and 10-year contract term

Capital accumulation and disbursement

For those who see life insurance not only as risk protection but also as a financial investment, the conditions of the payout are of particular interest.

One of the most important facts when it comes to the later payout. The payout of the life insurance only has to be taxed slightly. This makes it particularly interesting for supplementing your own pension later on.

How much you get in the end depends on the individually concluded insurance. Parameters such as age, term, sum and health play a role. If you are a smoker, for example, you will pay a significantly higher premium than non-smokers.

How is the life insurance premium calculated?

- Age at conclusion of contract

- Term (especially for term life insurance)

- Health

- Sum insured

Statistics and interest

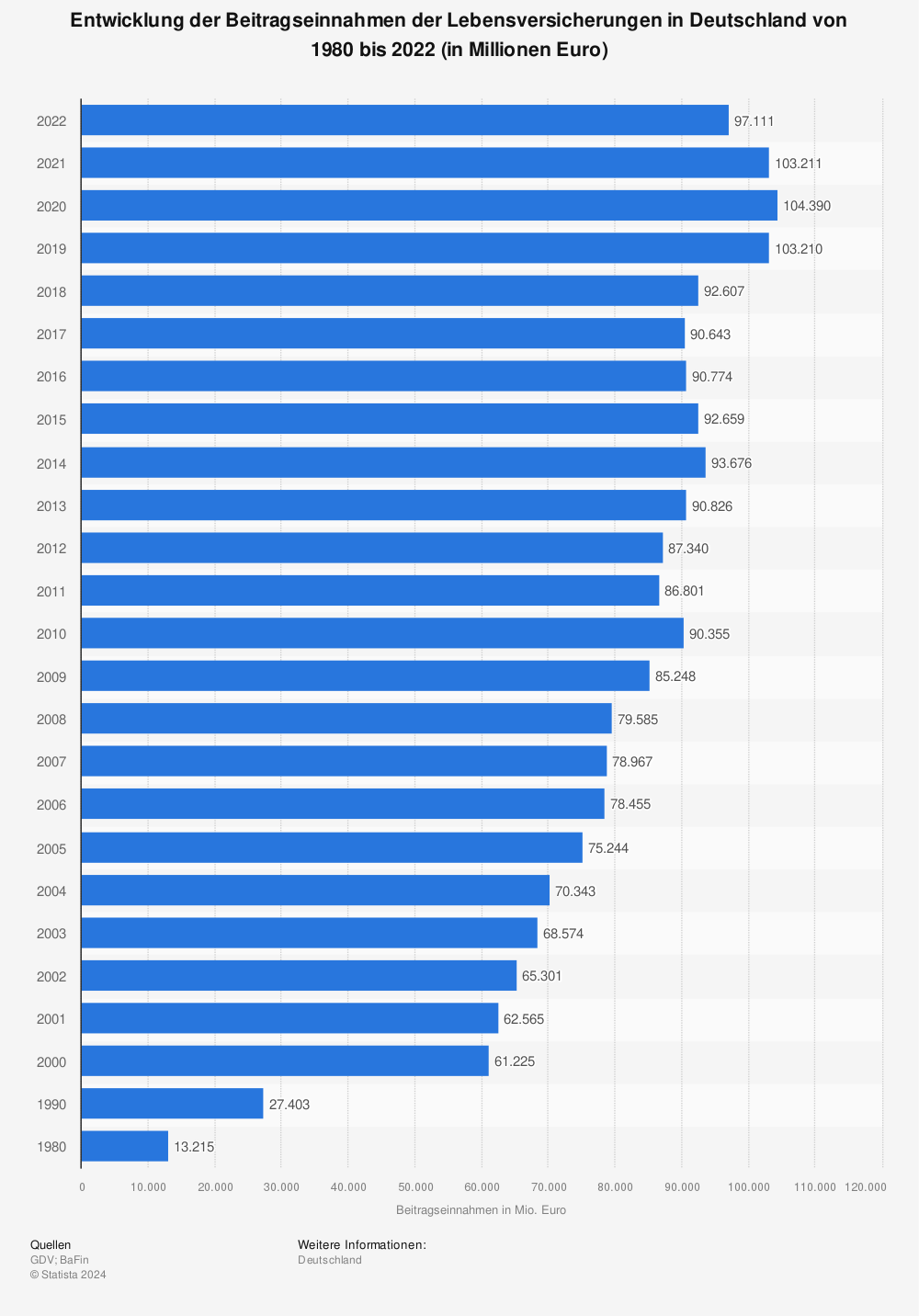

Premium income of life insurance companies

Looking back, here you can see the development of life insurance premium income in Germany from 1980 to 2018 (in millions of euros).

Source: Statista

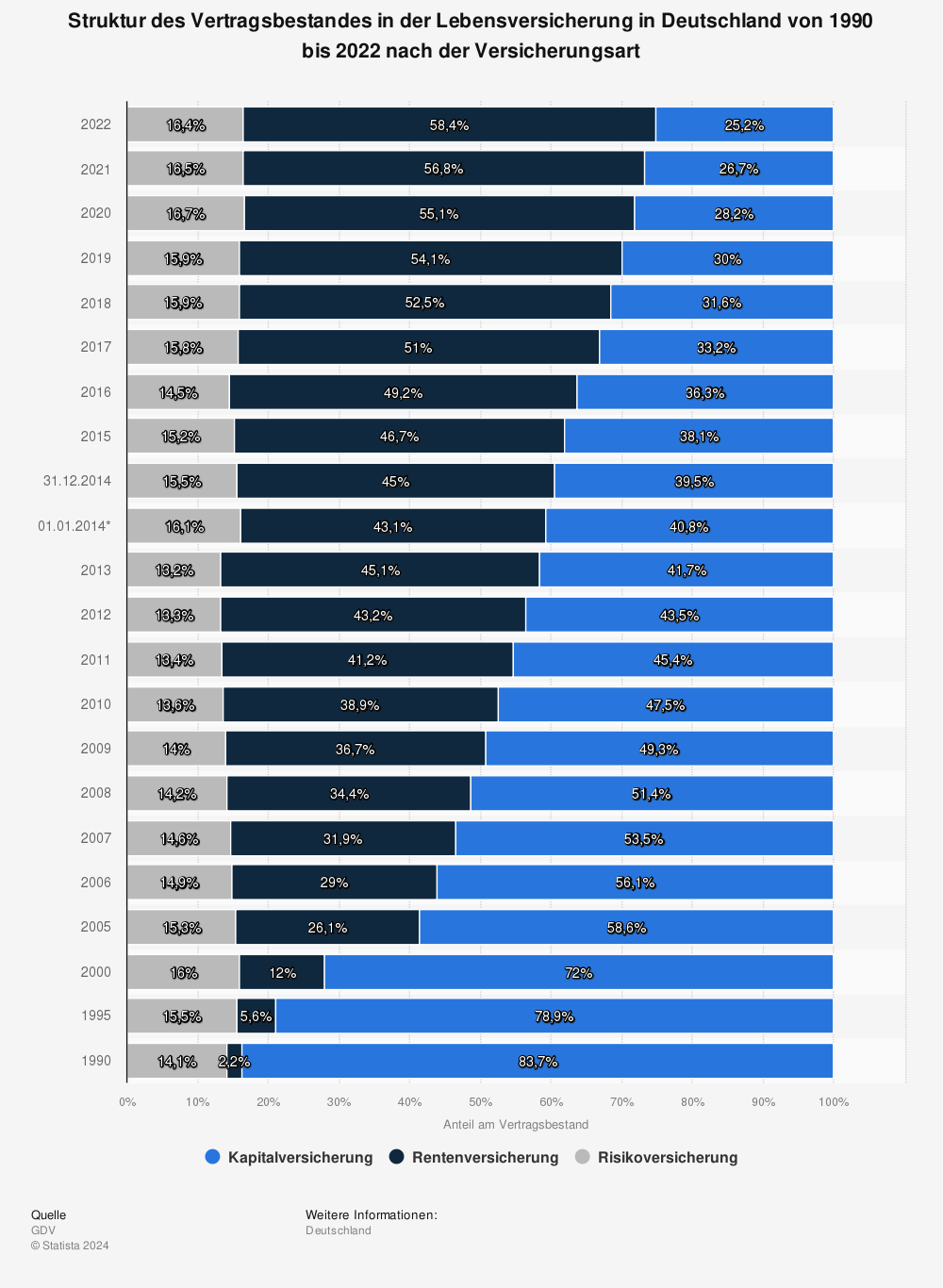

Life insurers’ portfolio of contracts

Structure of the contract portfolio in life insurance in Germany from 1990 to 2018 by type of insurance.

Source: Statista

Current interest

Here you can see the current interest rate of life insurers in Germany from 2000 to 2019.

Source: Statista

Interest rate development of life insurers

| for new contracts concluded during the year | RV current interest rate (in percent) | LV current interest rate (in percent) |

| 2008 | 4,39 | |

| 2009 | 4,29 | |

| 2010 | 4,20 | 4,19 |

| 2011 | 4,07 | 4,07 |

| 2012 | 3,91 | 3,90 |

| 2013 | 3,61 | 3,58 |

| 2014 | 3,40 | 3,37 |

| 2015 | 2,54 | 2,52 |

| 2016 | 2,86 | 2,84 |

| 2017 | 2,61 | 2,59 |

| 2018 | 2,47 | 2,49 |

| 2019 | 2,46 | 2,47 |

Current interest without terminal bonus and participation in valuation reserves | Source: Assekurata (as of February 2019)

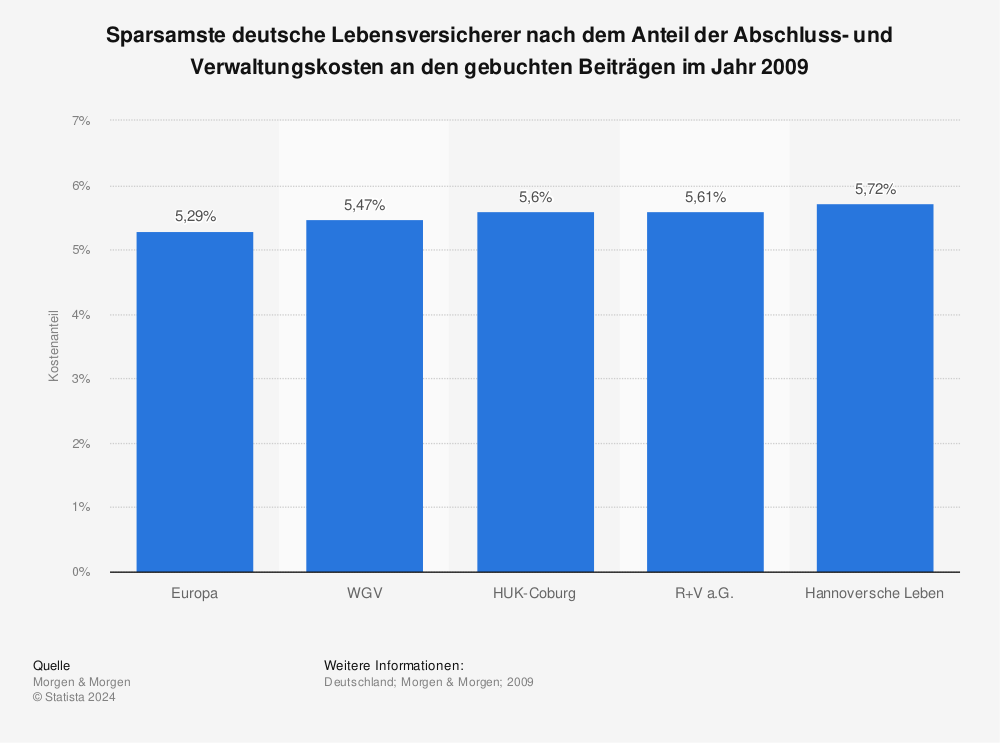

Most economical insurers – comparison

These are the most thrifty German life insurers according to the share of acquisition and administrative costs in premiums written in 2009.

Source: Statista

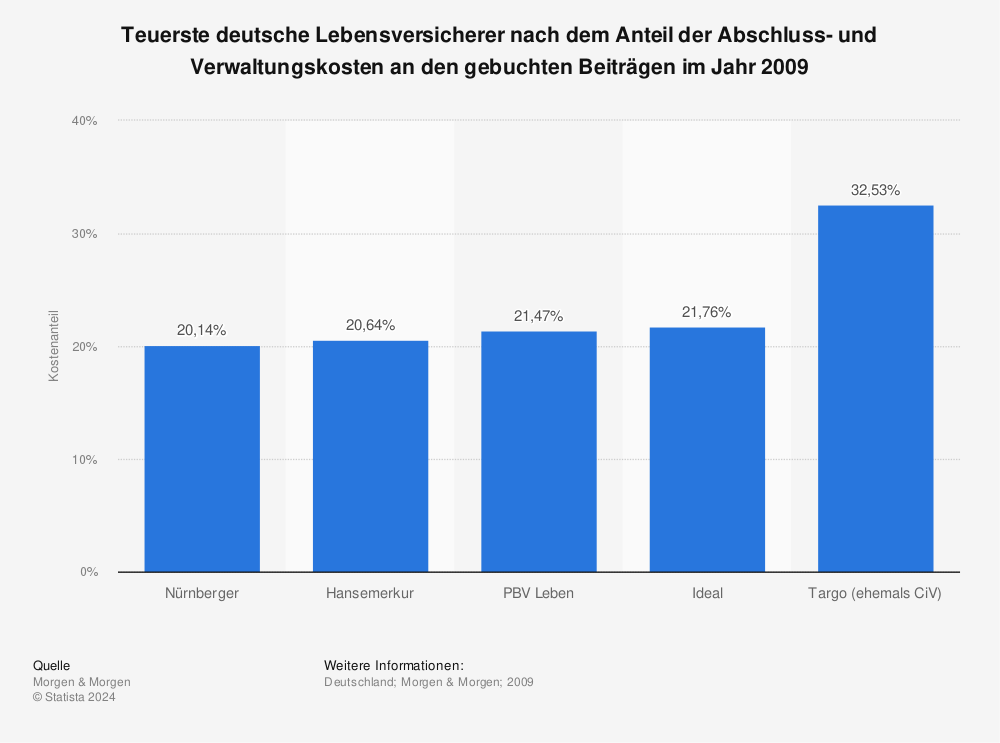

Most expensive insurers – comparison

Here you can see the most expensive German life insurers according to the share of acquisition and administrative costs in premiums written in 2009.

Source: Statista