Pension and inflation: deductions, risk & shock! – Real estate as a way out

Retirement and Inflation – Retirement is a touchy subject among the younger generation today. In our last article on wealth accumulation, you already learned what inflation means. Here we will show you the effects of inflation on your future pension. Here the question arises again, whether a real estate as capital investment or investment real estate is not therefore the better kind to the age precaution, as an investment in the bank or the legal pension precaution. In this article, we compare your three alternatives to show you the best way to stop worrying about your assets in old age.

How does the pension system work?

The pension system in Germany is based on three pillars; statutory, occupational and private pension provision. Many people are probably aware that this system is not doing too well these days. Read here what the three pillars are all about:

Here is an overview of the three pillars:

- Statutory pension provision

- Occupational pension provision

- Private pension provision

Statutory pension provision: Collecting points for all they’re worth

Statutory pension provision ends up not really being worth talking about, thanks to certain factors such as inflation, i.e. the devaluation of money. Roughly speaking, “pension points” must be accumulated, all of which have a certain value:

- Average earnings (< 60,000 euros gross / year): One point per year

- Below average earnings : Half point per year

- Above average earnings (> 60.000€ gross/year): Two points per year

The points are then added up to the pension and multiplied by the “pension value”. Here you can find the current formula for calculating the monthly pension amount:

Monthly pension amount = earning points x access factor x pension value x pension type factor

Here is a quick example to calculate the pension of an average earner:

Example: Average < 60,000 / year

Example (40 years of work):

- Pension points: 40

- Pension value current: ~ 34

- Standard age limit / pension type factor: 1

Monthly pension:

- 40 x 34 x 1 = 1.360 Euro

Factor source: German Pension Insurance.

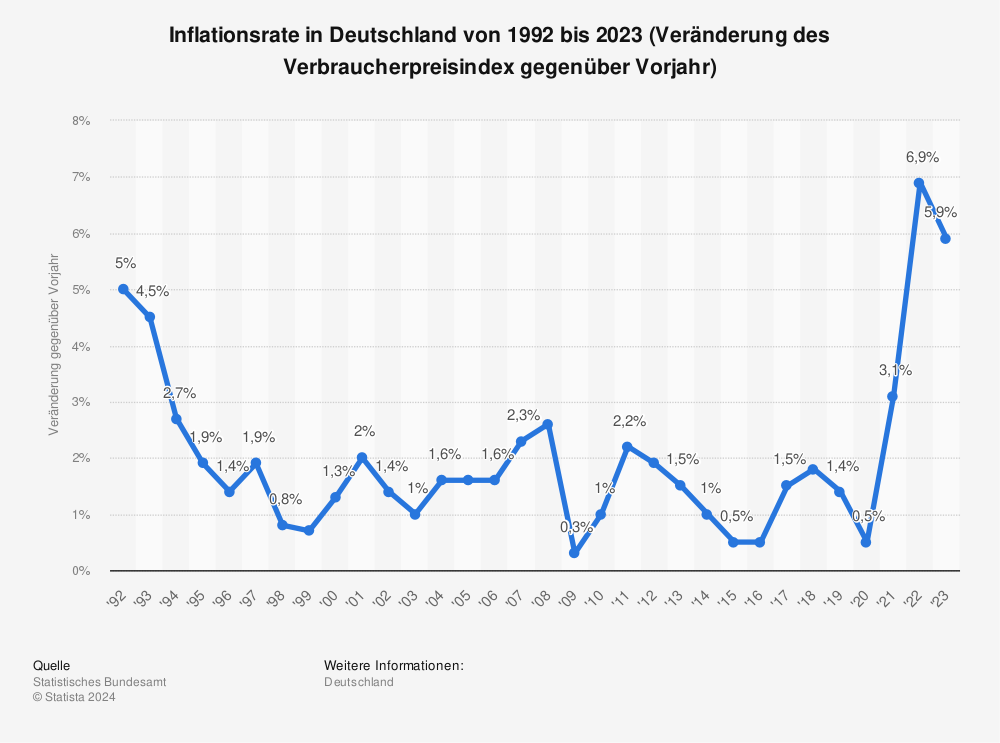

However, it does not stop there. Even with this amount, all taxes and inflation must still be calculated. Factors such as tax, health and long-term care insurance must also be taken into account. Especially inflation hits your pension hard. Don’t you think? Here you can find an overview of the change in the inflation rate in Germany from 1992 to 2020.

You can find more statistics at Statista.

Occupational pension provision: Secondary cover as a solution?

The company pension scheme is an additional safeguard to the statutory pension scheme. It is considered a supplementary pension and is financed by the employer. Even with this, it is difficult to cover one’s costs in old age.

Private pension provision: Investment in real estate

Let’s move on to private pension provision. The first question that arises here is how do I invest my money and in which form of investment should I invest at all? Inflation is our biggest enemy when investing in a financial product, but it is our best friend when investing in real estate, as we have already described in the article Wealth Creation & Inflation.

Here briefly again in simply explained!

Investment form Financial product:

- 10,000 euros in a savings account are and remain 10,000 euros. Even if the money is only worth half in 30 years (inflation).

Investment form real estate:

- If you buy a condominium for 10,000 euros, the money in 30 years is only worth half, you get for your property 20,000 euros

As you can see well here, when you invest in a property, you are always very well protected against inflation and can also still make profits. Unfortunately, our pension is similar to the investment in a financial product – in the end, we all make a loss.

The next step: real estate as an investment

This article compares the classic investment of money in the bank with a capital investment in the form of real estate. Real estate creates “real value”. Find out what that means here!

Learn here about the benefits of investing in real estate for your retirement savings, too!