Stocks, funds, gold or real estate?! Financial trends in the Corona crisis – Analysis

Every crisis has its very own winners. In our big investment guide, we have talked about the various forms of safe investments. These include the very safe models, e.g. savings accounts, time deposits or overnight money as well as speculative investment objects and shares. By the serious Corona Pandemie the courses of the large stock exchange indices plunge into the cellar. No matter whether in America, the United Kingdom or in Germany. Golden times for buyers? We want to analyze the market and look for you on the current trends, which we could win on the basis of the changes of the search inquiries on Google.de. Gold, shares or rather real estate, how have the search queries changed in the last days and weeks?

Economic impact of COVID-19

No sooner does the DAX fall than enquiries about shares and equity funds rise. Securities enjoy increased popularity in every crisis. This development can also be clearly seen in the trends that have emerged in recent days and weeks. The interest of people in shares has grown by a whole 400%, as we will see in a moment in the analysis. Because the stock market in particular has become extremely interesting for many buyers due to the currently falling prices. As soon as the economy jumps in again and the prices rise, a few euros can be taken along so quickly – so the thought.

There are hardly any losers. Interest in long-term investments is falling slightly, e.g. the purchase of real estate. The declines in search queries for individual jewellery investment forms such as luxury watches, for example Rolex and Patek Philippe, are greater. Jewellery as an investment is also falling in the trends.

So the buyer markets are leaning more towards equities and funds at the moment, looking at pure interest.

Asset Management

People are concerned about their wealth, as evidenced by the general increase in interest in the topic, which is up 68%:

Before we take a look at the individual charts of the developments and trends, here first a look at the current state of the DAX as of today. Clearly visible here is already the first small slump, just a few days after Germany was sent into a “lock down”. Economic experts are currently speculating a 5% to 8% drop in economic output. In many countries, 40% of economic output is collapsing, reports the Süddeutsche. The consequences of the Corona crisis are not to be estimated thus at present yet. This is also reflected in the DAX.

DAX at the beginning of April 2020: Price losses

- February 2020: 13,702

- Beginning of April 2020: 10,056

- Loss: -36.25%

DOW Jones Beginning of April 2020

Economic slump in the travel industry

90% of the airplanes are on the ground and parked. The crisis in the travel industry is only a part of the whole but it clearly shows how hard German companies but also international companies are hit by the current crisis.

In addition to the international travel restrictions, there are now even regional restrictions, e.g. when crossing individual federal states. For example, people from Hamburg, who inevitably come to Schleswig-Holstein when leaving Hamburg, have to turn around again directly at the city limits. Travel restrictions prevail locally and globally. These international and regional restrictions are having a severe impact on the industry. Accordingly, the share prices of the companies are also falling.

TUI share falls by -66.63

Falling share price for TUI:

- Before Corona: 11,42 Euro

- To Corona (beginning of April): 3.81 euros

- Price loss: -66.63

Investment comparison

Want to learn more about investments and the different alternatives? Read our big, free guide on the subject of investment comparison here.

Trend: Winners among financial investments

Who are the current winners at the start of the crisis? Here is a look at the current trend charts.

As described above, the clear winners of the crisis are currently equities and funds.

Shares

Equity funds

Gold

Interest in gold is currently rising only moderately by a few percent.

Precious metals

Trend: Losers among financial investments

Where there is sun, there is shadow. Accordingly, there are investments that are currently rising in interest but also investments that are less in demand. This currently includes the real estate market and luxury goods such as jewelry. In the points real estates is however immediately for all-clear ensured, experts prognosticate that this Delle is only a short term trend. As can be seen in the overall development (chart 3 below) of real estate values, investment properties consisting of houses and condominiums are rising steadily in value. In the long term, real estate remains an extremely attractive investment.

Save

The topic of saving in the form of savings books, fixed-term deposits or even overnight money is losing interest above all.

Real Estate

While shares and funds are currently increasing interest, interest in real estate as an investment in the form of houses, condominiums and apartment buildings is falling slightly.

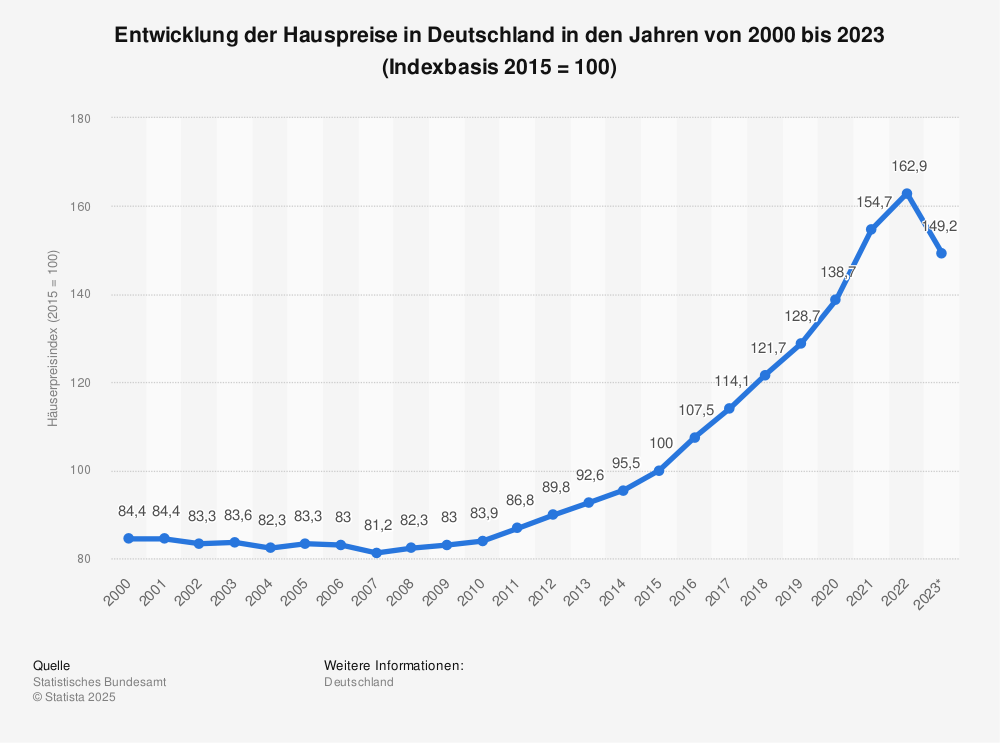

House price development: 2000 to today

Here you can see the development of house prices in Germany from 2000 to 2018 (2015 = index 100).

You can find more statistics at Statista

Jewellery as an investment: Rolex and Patek Philippe

Jewellery as an investment is also declining, as can be seen here in the example of the luxury brands Rolex and Patek Philippe.

Rolex trend in early April:

Patek Philippe trend in early April: