Real estate as an investment: 5 tips from experts

5 tips from experts for successfully investing in real estate as a capital investment – Real estate has always been considered a stable and profitable form of capital investment. If you’re thinking about investing in real estate, there are some important considerations and strategies that can help you succeed. In this article, you can benefit from tips from real experts who share their valuable advice. Take the first step to real estate investing now! Click here to return to the

Earn money with real estate

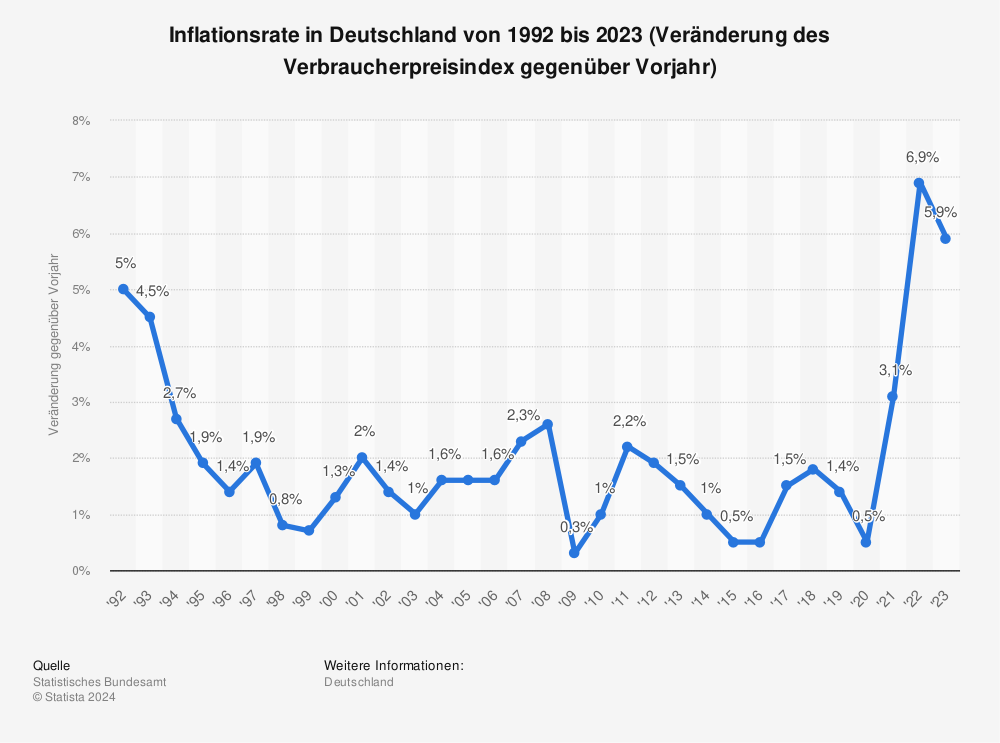

Capital investments are currently becoming increasingly popular as protection against inflation. Inflation reduces the purchasing power of your money over time. Rising inflation therefore basically devalues your money. This is shown by the inflation rate in Germany.

You can find more statistics at Statista

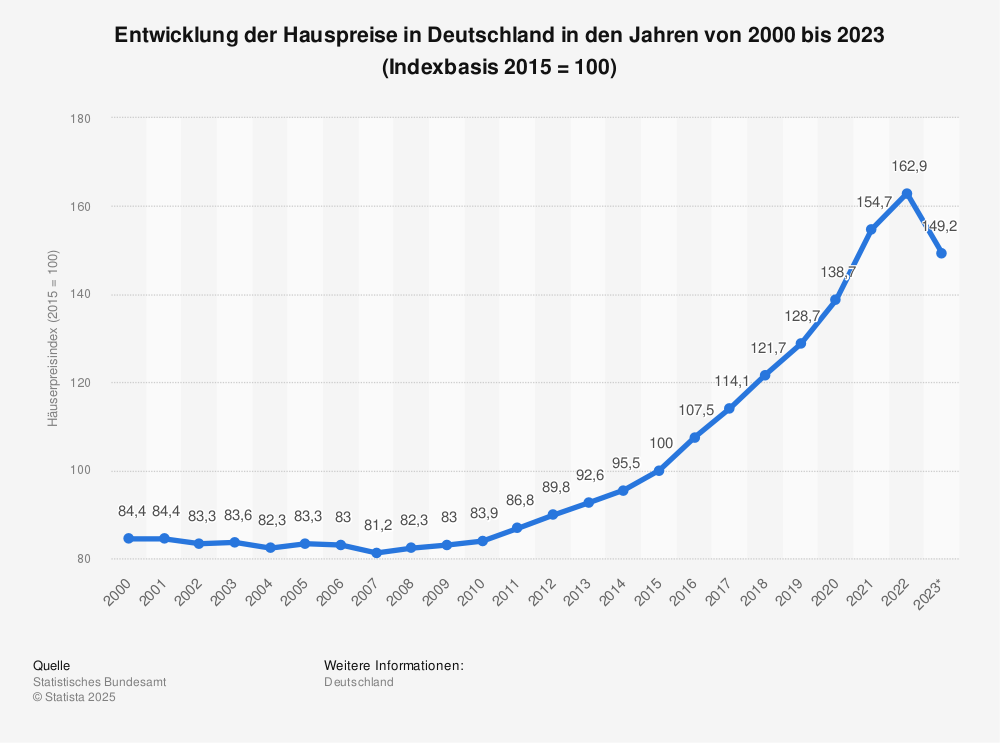

In contrast, real estate prices are rising nationwide every year. This is due to social growth, urban growth and a decline in living space. This is also shown by the Federal Statistical Office’s house price index.

You can find more statistics at Statista.

Real estate increases in value over time, and can therefore not only secure the value of your money, but also serve as a wealth accumulator.

Achieving financial freedom with real estate

For more and more people, investments are the path to financial freedom and a secure pension. If you want to make money with real estate, you buy properties in good locations with a profitable yield with the help of financing from the bank, then rent out the property and pay off the monthly installments through the rents. In the long term, the investor makes an additional monthly profit that goes into their account.

Of course, that’s not all you need to know as a real estate investor. To minimize the risk of losses, you need as much know-how as possible. Good news! You don’t have to start from scratch or trawl through thousands of books. There are already many experienced investors who have successfully made their money with real estate. That’s why this article gives you 5 tips from real experts on the subject.

5 tips from real professionals

If you are thinking about good investments to increase your wealth, buying a property as an investment is the way to go. Real estate is a proven way to optimize your wealth and achieve financial freedom. Are you a total newcomer to the business? No problem. There are already hundreds of success stories of experts who have made money with real estate. We’ve compiled the knowledge for you in one article. Here are 5 tips from real professionals!

Insider tip: location is the key to success

The first tip promises to be the big secret behind real estate success. The location of a property is crucial to the success of your investment. Real estate experts recommend investing in prime or up-and-coming neighborhoods, as they often offer the best rental income and performance. A-locations are prime locations close to key facilities and amenities. B-locations offer a happy medium, while C-locations are a cheaper but riskier option. It is important to choose the right strategy for your future plans. Your choice should therefore depend on your investment goals and risk appetite.

You should remember this about the various location strategies:

- A-location – expensive & profitable

- B-location – the good center

- C-location – inexpensive & risky

Careful yield calculation protects against losses

The return is a decisive factor in the assessment of a capital investment. The key word here is: return formula. Experts recommend calculating a gross yield and a net yield. The gross yield considers the annual rental income in relation to the purchase price of the property. The net yield also takes into account operating costs, taxes and financing costs. It is recommended to make sure that the return matches your financial goals before you invest.

The gross yield helps with initial decisions for or against an investment in a property. Before drawing final conclusions, however, the net yield should also be calculated. Otherwise, later losses cannot be ruled out.

It is important to know:

The net yield is more secure than the gross yield calculation.

In our guide to real estate investments, we reveal how high the yield currently needs to be:

A smart and well-considered approach to financing

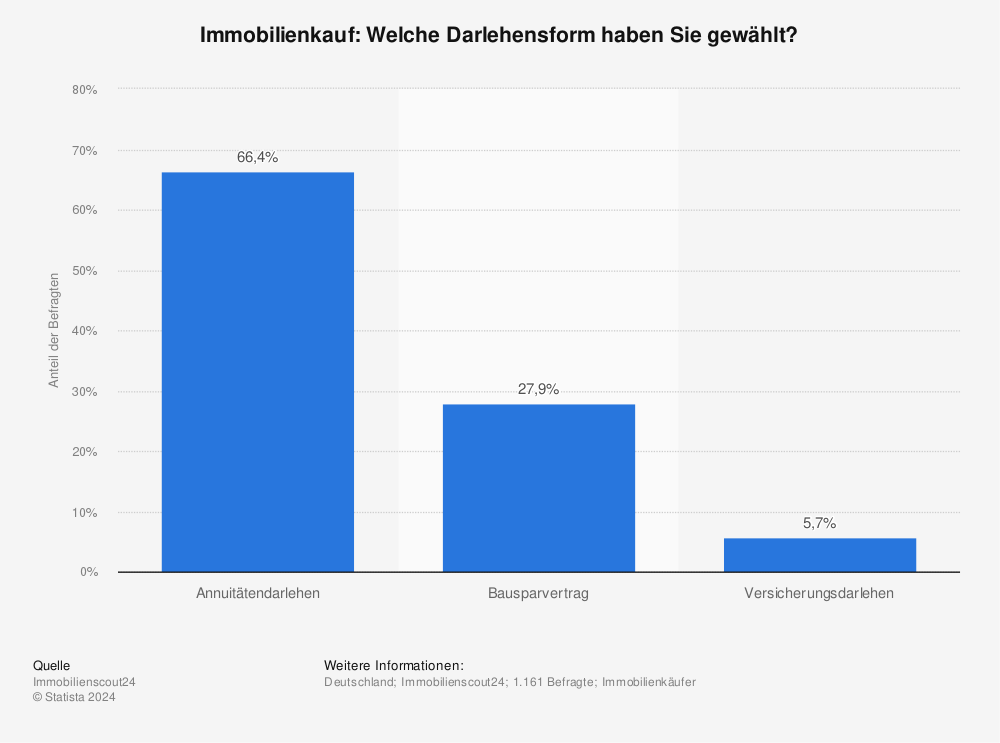

The right financing is crucial. It is advisable to use at least 20% equity to minimize mortgage interest and risk. Make sure you have checked your credit rating and can pay the monthly installments without any problems. Choosing the right financing option can make a significant difference in your real estate investment in the long run. Usually, an annuity loan is taken out as a loan.

You can find more statistics at Statista

Those who think short-term end up spending far more

Real estate investments should be viewed with a long-term perspective. Experts recommend not investing in real estate if you expect short-term gains. Demand for housing increases over time, which offers long-term benefits. Plan for long-term success and remain patient.

Professional support takes you to the next level

It may be advisable to seek professional help. Real estate agents, financial advisors and tax experts can offer valuable advice and support. An experienced real estate expert can help you choose the right property and manage your investment. Our tip: Many real estate advisors offer a free initial consultation where you can ask all your questions about real estate investment.

The most important statements of the professionals summarized

Real estate investing requires research, planning and a clear strategy. By following these tips from experts, you can increase your chances of success and build your portfolio as a real estate investor. Let’s recap what really matters.

Investing in real estate can be a smart investment if you pay attention to the right factors. The choice of location, return targets and the right financing are crucial to your success. Remember that real estate investments require patience and are best invested for the long term. If you keep these points in mind, real estate as an investment can be a lucrative investment that offers you long-term financial stability.

Get off to a good start with real estate with the guide for beginners – one article to learn everything you need to know!

Guide for beginners

You’ve decided you want to invest in real estate – that’s a great idea! Real estate can be a stable and profitable form of capital investment. If returns and positive cash flow are still foreign words to you, then you’ve come to the right place. We unravel the mystery of the money-making machine that is real estate ownership. In this article, you’ll learn the basics of investing. Location, yield, financing: what really matters?

Real estate as an investment for beginners