Investment call money: Rising deposits with falling interest rates

Deposits rising as interest rates fall? Overnight money is more popular than ever, as we will see in later infographics and comparisons. Overnight money has the unbeatable advantage of being extremely safe due to bank deposit insurance and government bailouts, and flexible availability, unlike investing in a fixed deposit account with a binding term. But what is call money? What is a call money account? Where is the best overnight money for investors? Who has the best interest rates for overnight money? Is a call money account free? What exactly is a call money account? What’s the difference between a current account and a call money account? Together, we take a look at the advantages and disadvantages of overnight deposit accounts.

Back to the Capital Investment editorial.

Per diem: Advantages and disadvantages

Call money is absolutely easy to set up, often the offer is already included in the account opening. Your deposited capital is available at any time and for the start with call money you need only low investment income or income.

Due to the current interest rate development, as can be seen later in the statistics, the capital increase via the overnight money is only worthwhile from very high amounts of money. For this you have a very low, almost no risk in your investment. The current yield of call money is as described very low, which is little to no risk, but you will hardly make any profit. Overnight money is like time deposits and savings accounts easy to set up in many bank branches and of course online. Your capital is available at any time.

Facts about call money

The most important 3 facts about call money:

- Available for everyone

- Constant availability of your money

- Low return

Call money is a flexible savings option for small savers. You can access your money at any time, but the returns are more moderate than with fixed-term deposits.

Advantages of the call money account

- Easy account opening

- Often already present at the regular opening

- Capital can be called up and is available at any time

- No large equity capital required for the start

- Low risk

Disadvantage of the call money account

- Yield only with large sums of money

Only one disadvantage, but it is precisely the return that is the focus of investment. If you want to play it safe, overnight money is a good, safe and flexible investment. Those aiming for greater profits should also look at alternatives to overnight money.

Statistics and infographics

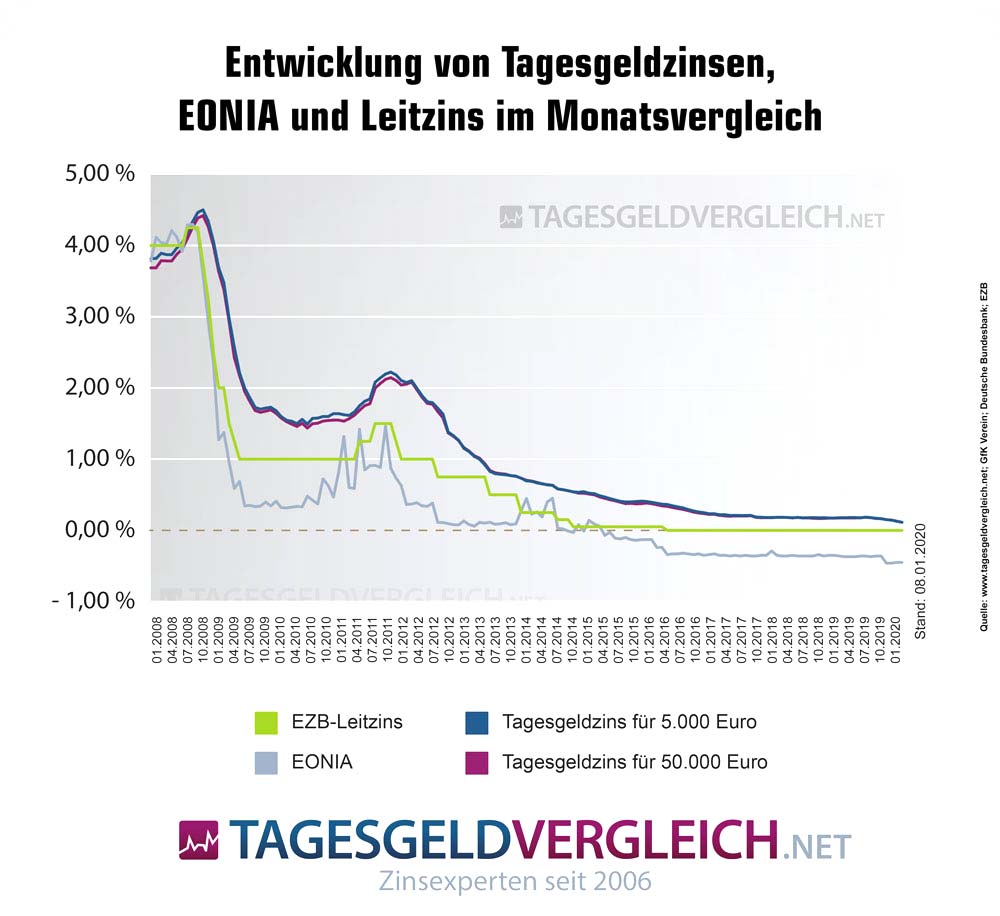

Call money comparison: Interest rate development from 120+ banks

The basis of the interest rate statistics are currently 12 tested call money accounts, which you can also find in all call money comparisons.

- 2008 by 4.15%

- 2010 by 1.12%

- 2012 by 1.22%

- 2014 by 0.39

- 2016 by 0.12%

- 2018 by -0.03%

- 2020 by -0.08%

Source: Tagesgeldvergleich.net

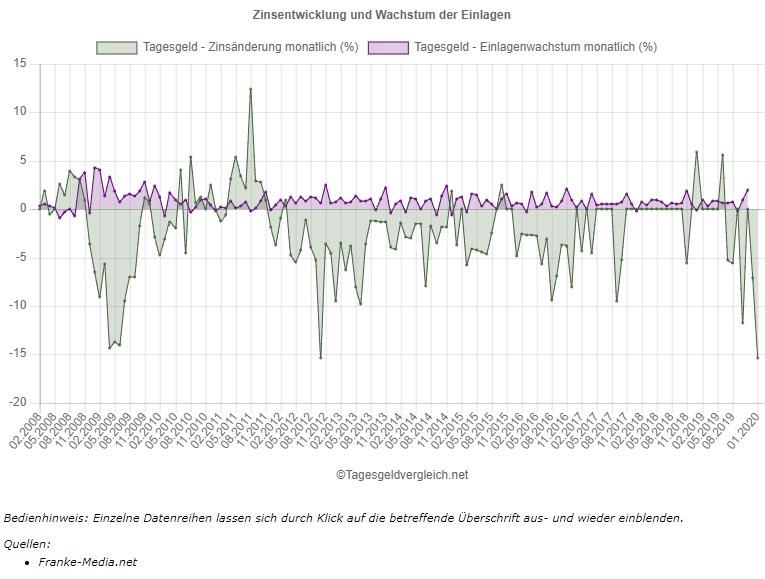

Comparison of interest rate development and amount of savings deposits

How do interest rate trends compare with the level of deposits? Normally, one should generally be able to assume that the falling interest rates, which are currently dependent on the interest rate situation, will result in a corresponding decline in the interest of savers.

However, as you can see from the chart, this is not necessarily the case, as a look at the infographic below shows. In the chart you can see how the interest rates on call money accounts have been falling steadily since the beginning of 2012, but the amount of deposits of private households with daily maturity almost always rises. As we have already noted on the subject of savings accounts, this is mainly due to the scepticism of savers towards the stock market and the economy.

Source: Tagesgeldvergleich.net

Call money in the top 3 investments

What investment options do Germans currently use? Call money is one of the top 3 forms of investment in this country.

Source: Statista

Direct comparison of call money, time deposits and savings bonds

| Call money | Fixed Deposit | Savings bond | |

|---|---|---|---|

| Possible interest | from 0 up to 0,50 | From 0,001 to 1,97 | 0,1 to 1,97 |

| Investment amount | 1 to unlimited | 1 to unlimited | 1.000 Euro to unlimited |

| Investment period | unlimited | 30 days to 10 years | 1 to 10 years |

| Security | at least 100,000 euros through the statutory deposit guarantee (note S&P country rating) | at least 100,000 euros through the statutory deposit guarantee (note S&P country rating) | at least 100,000 euros through the statutory deposit guarantee (note S&P country rating) |