Real estate loan: How much house is in it?

Real estate loan: How much house can you afford? – Taking the step towards home ownership is an exciting adventure. In an ever-changing real estate market, you may be asking yourself: How much house can I actually afford? In this article, we dive into the world of real estate loans to show you how you can realize your dream of owning your own home. We’ll highlight the challenges and opportunities that await you when buying your first property and give you a comprehensive overview of the basics of real estate financing. Ready to take the first step? Let’s go!

Basics of the real estate loan

What is your maximum purchase price? Very few of us are in a position to pay for a house or apartment in full with our own funds in one go. Instead, loans allow you to divide the high costs into smaller payments, which you often pay back over decades due to the particularly high amount.

However, as you also have to add interest to the borrowed money, it is important not to take out a real estate loan without thinking. Thorough planning is important so that the financial burden of the monthly installments is not too high later on or you may not be able to pay off the loan at all and get into difficulties. In this section, we therefore describe the most important basics of a loan so that you can make an informed decision.

What is a real estate loan?

A real estate loan is a loan that is granted specifically for the purchase or construction of a property. In contrast to other types of loan, such as an installment loan for consumer goods, a real estate loan is earmarked for a specific purpose. This means that you can only use the borrowed money for a property or construction project that has been specified in advance.

In return, the real estate loan is usually secured by the property itself. This means that the bank has the right to sell the property if you are unable to repay the loan. As the bank takes a lower risk of loss, you receive more attractive conditions in return, such as lower interest rates.

How a real estate loan works

The way a real estate loan works is relatively simple: you borrow money from a bank or other credit institution to buy or build a property. You repay the loan in monthly installments over a fixed period of time, which consist of interest and repayment.

- The amount of the monthly installment depends on various factors, such as the amount of the loan, the interest rate and the term of the loan.

Think about how much you can afford to pay each month without compromising your standard of living. You can use various online calculators to do this. You can quickly calculate your installment loan using one of these tools. Simply enter the loan amount, the term and the interest rate and the calculator will determine the monthly installment for you. You can adjust the individual factors and see how the results change as a result.

- In most cases, such calculators also take you directly to a comparison of possible real estate loans that are currently available and match your details.

The complex interplay of credit conditions

When looking for the perfect loan, the focus is on the conditions. When comparing several providers, it is important to take a close look at them and choose a combination that suits your project. However, the attractiveness of the loan also depends on factors that you determine yourself.

- Aspects that can be influenced, such as the term, can have an impact on how high the interest rate is or how much you have to pay per month.

Important interactions are:

Equity and interest rate

The more equity you put into the property purchase, the lower the risk for the bank. This reduced risk is often rewarded with a lower interest rate.

Term and interest rate

As already mentioned, the term of a loan directly influences the interest rate. Shorter terms usually lead to lower interest rates, as the bank gets its money back more quickly. However, this also increases the monthly installment.

Creditworthiness and credit conditions

Your creditworthiness or credit rating plays a decisive role in determining the loan conditions. A good credit rating, demonstrated by a stable source of income and a positive credit history, can lead to better credit conditions.

Special repayments and repayment plan

Some loans allow you to repay a larger amount once a year without incurring additional fees. This can help you repay the loan faster. However, loans with this flexibility can sometimes have higher interest rates.

Fixed interest rate

The fixed-interest period also influences the conditions. A long fixed-interest period gives you certainty about the interest rate over a longer period of time, but can lead to higher interest rates than a shorter fixed-interest period.

Total cost of the loan

Pay attention not only to the monthly installment or the interest rate, but also to the total cost of the loan over the entire term. A low interest rate for a long term can be more expensive overall than a slightly higher interest rate for a shorter term.

Choosing the right loan conditions requires careful consideration of all factors. Your personal financial situation and your long-term goals should therefore be the guidelines when deciding on a real estate loan. Loan calculators are a great help here.

Real estate selection and budget planning

The loans and conditions you can access for a property purchase are an important part of the budget calculation of which house you can afford. On the other hand, there is the property selection, which includes both your wishes and the current selection of living space.

Understanding the real estate market

Before you start looking for a property, it is important to understand the current real estate market. This includes knowing about price trends in different regions, the demand for certain property types and future development trends.

- You can find information on this in real estate reports, online platforms and by talking to real estate experts.

Real estate selection

When choosing a property, you should consider the following aspects:

- Location: The location of a property is one of the most important factors when buying real estate. Think about what infrastructure you need and what developments are planned in the area.

- Condition of the property: Realistically assess the condition of the property. Old buildings often have a special charm, but can cause high renovation costs.

- Size and layout: Do the size and layout of the property suit your current and future needs?

The location, size and condition of the house will have the biggest impact on the house you can afford. You will probably have to make compromises here to find the perfect home. In big cities, for example, you will be able to afford much smaller properties, if at all. In the countryside, you’ll have to be prepared to commute.

- The reason for the purchase can also have an influence here, such as whether you want to live in the house yourself or are buying it purely as an investment.

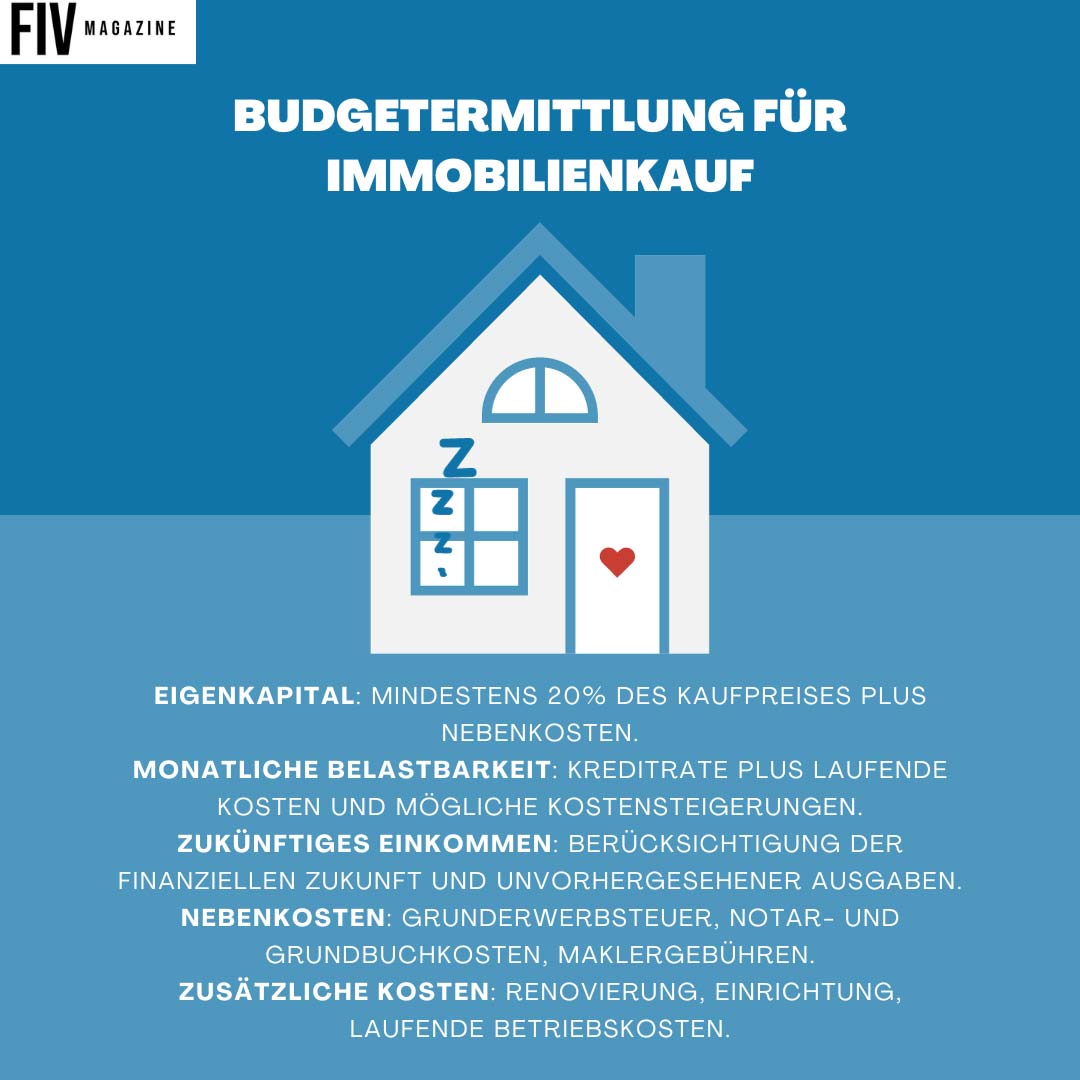

Budget calculation: How much house can you afford?

Planning your budget and choosing the right property are crucial steps on the way to owning your own home. A realistic assessment of your financial possibilities and thorough research into the real estate market are essential in order to make an informed decision.

Conclusion: How a real estate loan works

From the basics of real estate loans and the interplay between different loan conditions to carefully planning your budget and choosing the right property – all of these aspects are crucial when buying a home. In the end, the current market, the choice of property, your income and expenses and the exact structure of the real estate loan together determine which house you can afford. By choosing the right time and the perfect balance of conditions, you can find exactly the loan that will bring you closer to your dream home.

Buying your first property: step by step!

Of course, there’s a little more to buying, what do you need to prepare for? What mistakes do you need to know and avoid? Learn everything you need to know here: