Buy Diamond: Price, carat, color and gold comparison – Investment Gemstone

Buying Diamonds – The entire top 10 producers only generate a little over 1 ton of rough diamonds a year. Not enough for all the jewelry, engagement rings, and capital investors in the world. That’s why the price of diamonds is so high. The 4Cs determine the value of each stone. The most complex is the diamond cut. Diamonds are 583x more valuable than gold. 1 gram of gold currently costs 61 USD, for 1 gram of diamond (5 carat) you get +35,519 USD more. The largest diamond ever found is “The Golden Jubiliee” with 545.67 carats. A theoretical value of 3,882,987 USD, but its uniqueness makes it pretty much unmeasurable, there is no second one. Here is the guide: Diamond as an asset, cut, color, carat and price comparison.

Diamond price (gram, carat and kilo)

The largest diamond producer by volume is Russia (mainly Siberia). But if you look at the value of the diamonds, Botswana (mainly Jwaneng Diamond Mine) wins. Both produce over 1 million carats a year, which sounds like a lot, but is actually only 200,000 g, or 200 kg per country per year. It is these small quantities that make diamond so valuable.

The most famous and legendary of all gemstones, diamond is very unique in many ways. It is known for being the hardest substance on earth, its sparkling fire, durability and rarity make diamond the most valuable of all gemstones. No gemstone contains as much attraction and interest as diamond. Most diamonds used as gemstones are colorless or very faintly colored. Colored diamonds, called “fancies,” however, can be extremely rare and valuable, and the most valuable gemstones ever known were fancy diamonds. In fact, fancy diamonds are the most valuable substances known to mankind, with colored diamonds selling for more than a million dollars per carat in the past!

What you’ll be most interested in now, of course:

How much does a diamond cost?

As described earlier, diamonds are weighed in carats.

One metric carat equals 0.2 grams

Diamonds are currently valued at an average of $7,116 per carat.

So one gram costs on average 35,580 USD

Diamond Price Current (08/20):

- 1 carat 7,116.17 USD or 5,990.54 EUR

- 1 gram 35,580.90 USD or 30,100.16 EUR

- 1 kilogram USD 35,580,170.34 or EUR 30,100,160.81

Gold price (gram, ounce & kilo) in comparison

How does the price of gold compare? Many investors who buy gold constantly keep an eye on the price. As an investor, you should too, because prices for precious metals are subject to fluctuations – even if the gold price is usually very stable.

Difference per gram currently: +35,519 USD or diamonds are 583x more valuable

Gold is currently valued at $61 per gram, compared to diamonds, which can fetch up to $35,580 as described, a huge difference that also makes diamonds interesting for investors.

Gold price current:

- 1 gram 61.14 USD or 52.47 EUR

- 1 ounce 1,901.77 USD or 1,631.90 EUR

- 1 kilogram USD 61,143.33 or EUR 52,466.80

So for one kilogram of gold you get only a fraction of diamonds!

Countries of origin and largest mining areas

Since the 1870s, most of the world’s gem-quality diamonds have been mined in Africa.

Top 7 producing countries over 1 million carats / year

These seven countries have been world leaders in the production of gem quality diamonds for over a decade.

Production over 1 million carats:

- Russia

- Botswana

- Canada

- Angola

- South Africa

- Democratic Republic of the Congo

- Namibia

Russia leads the list of producers with its gigantic areas. A large part of the productive mines can be found in Yakutia.

Mine: Yakutia, Russia

Inside Yakutia: Russia’s largest mine – video

Yakutia in northeastern Siberia is home to huge diamond deposits, where the gems are mined in huge pits dug deep into the permafrost. The Mir mine in Mirny is 525 meters deep and one of the largest man-made holes in the world.

Production countries with 100,000 + carats / year

Apart from the dominant producers, numerous countries produce less than one million carats per year, but are regular, consistent producers. They all produce over 100,000 carats of gem-quality diamonds per year and have averaged at least that much over the past decade. This production comes from smaller mechanized mines or an enormous number of artisans in alluvial deposits.

- Australia

- Ghana

- Guinea

- Guinea

- Guyana

- Lesotho

- Sierra Leone

- Zimbabwe

Number 1 in the 2nd division is Australia. Tip. Read more about production and price of Opal here.

Mine: Australia (Argyle Diamond Mine, Lake Argyle WA 6743)

Inside Argyle: Australia’s Diamonds – Video

A look inside the unique Argyle diamond mine. Located in the spectacular East Kimberley region of Western Australia, the Argyle Diamond Mine produces over 90% of the incredible Pink Diamonds. See how they recover the diamonds from deep underground in their modern block cave mine.

Russia: The largest diamond producer in the world

Diamonds were found in Russia as early as the 18th century. The first significant production occurred in 1957 from the Mir kimberlite pipe and adjacent placers. Since then, numerous diamondiferous pipes and alluvial deposits have been found. Most of Russia’s diamond production to date has come from the open pit mines of the Mir and Udachnaya pipes in the Sakha Republic of Siberia.

Today, Russia is the world’s leading producer of gem-quality diamonds by carat weight and has held this position for over a decade. Botswana is the only country with a higher production value – mainly because its production includes a high proportion of large, high-quality diamonds.

- First finds in the 18th century

- First production facility 1957

- The majority are open-cast mines in the Republic of Sakha.

- Central is Yakutia (10 of 12 mines)

- World leading producer in gemstone quality

- Holds the title for over a decade

ALROSA as the largest export company

ALROSA, a Russian group of diamond mining companies, produces almost all of the diamonds mined in the country. ALROSA sorts and sells its rough diamonds to a number of polished diamond manufacturers located mainly in Russia, Belgium, India, Israel, Hong Kong and China. Most sales are made through long-term supply agreements, but the company also makes one-time sales and is developing methods for online sales.

Primary control of ALROSA is in the hands of Russian government authorities. The Russian Federation Agency for State Property Management owns approximately 44%, the Ministry of Property and Land Relations of the Republic of Sakha owns approximately 25% and the municipal district administrations of the Republic of Sakha own approximately 8%. The remaining approximately 23% is owned by individuals and legal entities.

Away from it all, a look inside the mine is nothing short of spectacular.

Number 1: Largest diamond mine in the world – Video

Botswana: Small country, huge yield

Course a look at Botswana as a country if you don’t know much about it yet.

- Capital: Gaborone

- Currency: Botswana Pula

- Population: 2.254 million (2018, source: World Bank).

Botswana on the map, Jwaneng Diamond Mine:

Botswana was one of the first areas to use bulk sampling and indicator mineral mapping to characterize and identify diamond pipes in a large and difficult geographic area. Exploration began in the 1950s and diamond mining started in 1971.

In the mid-1980s, Botswana had some of the world’s highest-yielding mines, and the tiny country was one of the world’s leading diamond producers.

For over a decade, Botswana has been the second largest diamond producer by carat weight and the leading producer by value. It holds this position because its average diamond size is larger than those produced by Russia and of generally higher quality.

- Diamond mining began in 1971

- 2. largest diamond producer (quantity)

- PS: Measured by value, even the leading producer

Number 1 mines: The most expensive diamonds

Botswana’s Jwaneng mine is often referred to as “the richest diamond mine in the world”. The mine has been producing about 10 million carats of high quality diamonds annually. The mine is owned by a company called Debswana, a joint venture company between De Beers and the government of Botswana – hence the name “Debswana”.

The diamond industry is the most important factor for economic activity in Botswana. Diamonds account for about 60% of Botswana’s exports and about 25% of its gross domestic product. De Beers is responsible for the sale of all of Debswana’s rough diamonds and has built the largest diamond sorting and sales facility in the world in Gaborone, the capital and largest city of Botswana. There, the stones mined by De Beers in Botswana, Canada, Namibia and South Africa are sorted and offered to diamond buyers and manufacturers from all over the world in De Beers’ famous “Sightholder Sales”.

- Most important factor for economic activity in Botswana

- 60% of Botswana’s exports are diamonds

- About 25% of its gross domestic product

- Garborone has the largest diamond sorting and sales facility in the world

https://www.youtube.com/watch?v=wCEmCUdSnXc

Canada: The big surprise

Canada was the big surprise in the diamond industry. Geologists suspected that gem-bearing diamond pipes pierced the rocks of the Canadian Shield, but many of the world’s most experienced diamond explorers could not find them. Then in 1991, two geologists, Chuck Fipke and Stewart Blusson, found evidence of diamond-bearing kimberlite pipes about 200 miles north of Yellowknife, Northwest Territories. The deposit proved commercial, and mining began there in 1998. Several other mines came on line in quick succession, quickly making Canada one of the world’s leading diamond producers.

Some of the Canadian mines have already been closed due to difficult mining conditions or ore bodies being worked out. However, the country’s position as the third largest diamond producer in the world has been maintained. Most of Canada’s mines are located in remote and cold places in the northern part of the country. Some can only get their heavy supplies by trucks traveling on ice roads that can only be traversed during the coldest months of the year. The mines must also have all the necessary facilities to house and support their workers for months at a time. The mines have proven themselves even in the face of these costly challenges.

- First diamonds were found in 1991

- In 1998 the dismantling began

- Mines mainly in the north, supply via ice roads

Popularity due to good production conditions

Canadian diamonds have been very popular with consumers. Some like them because they are produced away from conflict, because workers are well paid and because there are regulations to protect the environment. Diamond and jewelry manufacturers in Canada have advertised their national origin by labeling their belts with certificate numbers and trade logos. These include a maple leaf, a polar bear, CanadaMark symbols or the words “Ice on Fire.” These inscriptions assure consumers of the provenance of their diamond, link it to a certificate, and are a very successful marketing feature.

Mining of rough diamonds

Diamonds are mostly extracted from vents of extinct volcanoes. They are first mined in open pits, then underground. Extensive open-pit mining of this type is carried out in Botswana, Russia and Angola. In Namibia and South Africa, diamonds are also found inland in some river valleys and in submarine basins. For underwater mining, specially designed ships are used to wash the diamonds out of the sand that is sucked in.

World production of natural diamond is currently around twenty tons per year, which currently only covers around 20 % of industrial demand. Synthetically produced diamonds, whose properties such as toughness, crystal habit, conductivity and purity can be precisely influenced, are therefore increasingly filling this gap in demand.

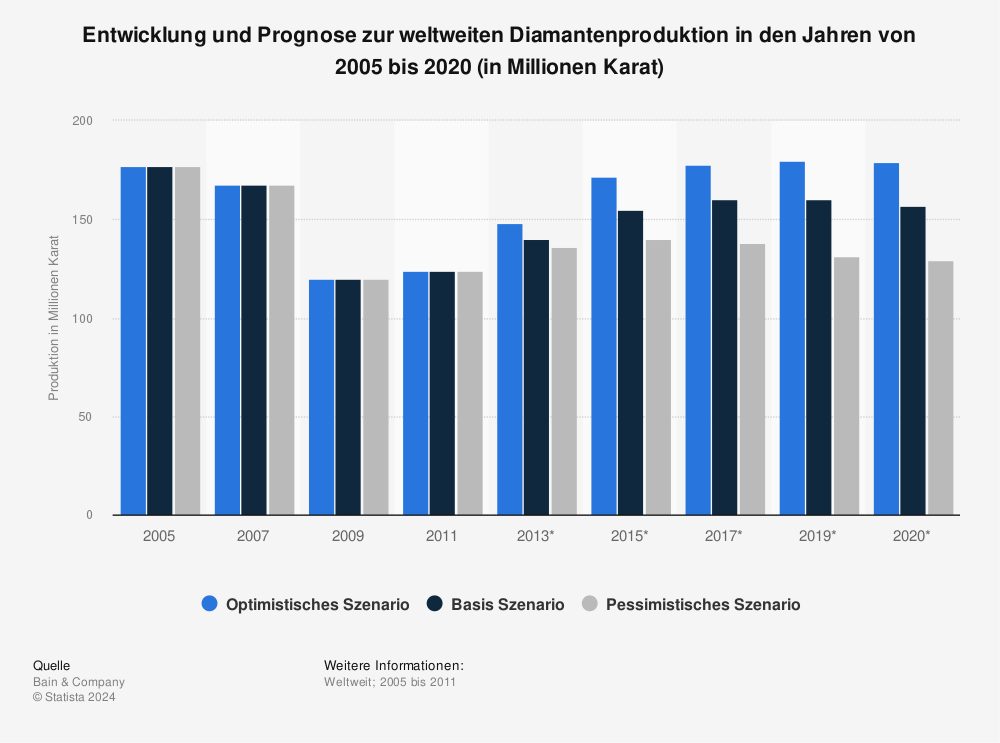

Statistics: Development of the worldwide diamond production in the period from 2005 to 2020

You can find more statistics at Statista

Recognised grading system: The 4 Cs

A grading system introduced by the GIA was established to evaluate diamonds based on four aspects. These four grading systems are known as “the four C’s” in which all diamonds are graded:

- Colour

- Cut

- Clarity

- Carat weight(Carat weight)

Colour (Colour #1)

The color of a diamond is graded on an alphabetical scale, ranging from the letters D to Y. This scale measures color saturation, which ranges from absolutely colorless to deep yellow (or yellow-brown). D is completely colorless, with no hint of any other color. Y indicates intense deep yellow or deep yellow-brown. The letters between D and Y describe the color, depending on the degree of yellow saturation.

The color bar below shows the letter and the color saturation it represents. (The bar is not limited to yellow; it can also be yellow-brown and is not necessarily accurate, as monitor saturation can vary.) The letter Z in a diamond’s color grade can sometimes be used to indicate a fancy diamond.

Cut (Cut #2)

The cut, or facet, of the diamond is the shape and style in which it is cut. The most common cut is the brilliant cut, a facet specifically designed to bring out the most fire in the stone. Sometimes this cut cannot be given, either due to flaws or cleavage habits. A great deal of planning must be done before cutting a diamond, as a slight flaw in the facet can significantly reduce the value of the stone.

Brilliant cut and old cut

The brilliant cut is the classic cut for diamonds. The 57 facets of the brilliant cause the best possible light reflection.

The old cut is the precursor of today’s brilliant cut. This particular cut is mainly found in jewellery from private collections. Special features of this cut are a somewhat higher upper body and a smaller table as well as a cut calette. A perfectly round cut was not necessarily aimed for. This cut still enjoys particular popularity among connoisseurs today.

Purity (Clarity #3)

The brilliance of the stone also depends decisively on the clarity, which is of course very strongly reflected in the value of the diamond. Truly flawless stones are very rare and therefore also particularly valuable.

Carat / Weight (Carat #4)

The size of a diamond is measured in carats (abbreviated as ct). One carat is equal to 0.2 grams (about 0.007 ounces).

Another weight measurement sometimes used for small diamonds is the point measurement (abbreviated as pt). Each point is equal to one/one hundredth of a carat. For example, a stone weighing 34 pt weighs 0.34 ct. Larger diamonds are worth more than proportionally smaller ones, meaning that a 3 ct diamond exceeds the value of three 1ct diamonds.

Diamonds (as well as other precious colored gemstones) are often sold with a certification document that lists comprehensive details about the stone, specifically their 4 C’s. These certificates are usually authenticated by recognized organizations such as the GIA and the AGS (American Gem Society) and offer authenticity about the stone being purchased. Diamonds that are certified have a premium over non-certified.

Detect fake diamonds?

Since a diamond is real, it must have some inclusions! These inclusions are visible to the naked eye or under magnification. If no inclusions, black spots or milk spots, are visible in a diamond, then it is either a zirconia or a piece of glass.

Diamonds that have no inclusions under 50x magnification are very rare and can only be found by collectors. The small black specks that are visible in diamonds are crystals of graphite or other forms of carbon. These black specks glow under the light. Diamonds have an affinity for grease; the surface of a cut diamond generally has a film of grease when touched.

- Inclusions (naked eye or under magnification)

- No inclusions under 50x magnification = very rare

- Black spots are crystals of graphite or other forms of carbon

- Affinity for fat

Test methods for the authenticity of diamonds

The most important test of a diamond is that all light entering the front of the stone is completely reflected by the back facets, which form a series of mirrors. A well-cut diamond, when viewed from the back and held up to the light, will show only a pinpoint of light from the cult. Moreover, when you look down at a brilliant diamond, you don’t see the wearer’s finger under the stone, as you do with other stones. White light entering a diamond is scattered into a spectrum of colors, creating vials of different colors from the smaller crown facets.

Detect diamond imitations: Video

Various quartz shapes

There are many forms of quartz that can be called diamond. Many are locality specific and precede the word diamond with a locality name. Many of these names are rarely used or invented by dealers, but there are a few, such as Herkimer Diamond, that are used universally. Here are some names to consider that describe quartz varieties:

Names describing varieties of quartz:

- Arkansas

- Baffa

- Bristol

- Cape May

- Cornish

- Dauphine

- Herkimer

- Hot springs

- Marble Marsh

- Pecos

- Vallum

- Zabeltitzen

Other false names are also used which do not refer to quartz. They are as follows:

- Alaskan Black – Hematite

- Jourado – Colorless synthetic spinel

- Killiecrankie – Colourless topaz from Killiecrankie Bay at the northern end of Flinders Island, Australia.

- Matura – Colourless zirconia

- Strass – Colorless glass as gemstone simulant

- Swarovski – Highly polished form of glass

Production of synthetic diamonds

For many years, it was very legitimate to use the terms “diamond production” and “diamond mining” as equivalent – at least for gem quality diamonds. That has changed. The United States Geological Survey reports that in 2015, an estimated $52.4 million worth of gem-quality diamonds were produced in laboratories within the United States.

Already produced $52.4 million worth of synthetic diamonds in 2015

An unknown quantity is also produced in laboratories outside the United States. Most of these synthetic diamonds enter the gemstone market and are labeled as “lab-created” or “lab-grown” or “synthetic” at the time of sale to consumers. When this occurs, these man-made diamonds are generally sold at a price at least 25% below the cost of natural diamonds for stones of similar size and quality.

Still complicated and costly at the moment

It is extremely difficult and costly to distinguish man-made diamonds from natural diamonds, especially at the wholesale level when synthetic diamonds are inserted into large lots of very small diamonds. This infiltration of synthetic stones into natural stone stock has raised concerns among the gem and jewelry trade, as well as consumers. Is my diamond “natural”?

Most consumers still buy “natural diamonds” because the supply of lab-created diamonds is relatively small. However, a lower selling price attracts certain consumers to lab-created diamonds because they have the same chemical composition and physical properties and look exactly like natural diamonds to the eye. Time will tell how interested consumers will be in natural diamonds and how much of a discount they are willing to refuse.

For a layman not to recognize: The difference between natural and synthetic diamonds.

Biggest diamonds ever

In this chart you can see the biggest diamonds that were sold until 2010:

- The Golden Jubiliee – 545.67 carats

- The Cullinan I – 530.2 carats

- The Cullinan II – 317.4 carats

- The Centenary – 273 carats

- The Millenium Star – 204.4 carats

Diamonds for investors

Investors should base the purchase decision on the “4 Cs” described above to ensure a minimum level of quality. In order to ensure successful resaleability at a reasonable price, it makes sense to keep the standards rather high.

Role of diamonds in the portfolio

In contrast to shares, ETFs or other forms of investment, the long-term price development of diamonds is characterised by a relatively steady rise. Therefore, diamonds are very well suited as a defensive addition to the portfolio to cushion strong downturns. A fundamental outperformance compared to stock indices such as DAX or MDAX, however, is usually not given.

Your motivation in buying diamonds as an investment should be to minimize risk by diversifying your assets.

This means that diamonds are not recommended in a small portfolio. If you have to exceed a maximum portfolio share of 5 percent to reach the minimum size and quality when buying diamonds, you should rather wait with the investment.

Diamond Cut: 21 Shapes & Types

Diamonds are known to have the unique property of refracting light in such a way that it sparkles intensely! So much so that diamonds continue to increase in value. Today, 1 carat (0.2 grams) will cost you 7,116.17 USD or 5,990.54 EUR. Besides the brilliance, the cut determines a large part of the purchase price. There are different shapes of cut diamonds, 21 of which I want to introduce to you today. To the cut forms belong for example round cut (also brilliant cut), heart, oval, marquise, radiant and princess (princess cut). The cut quality significantly determines the value of a diamond. When determining the value, it is all about how well the facets of a diamond interact with the light.

The cut of a diamond is crucial to the final beauty and value of the stone. Of all the 4Cs of diamonds, the cut itself is the most complex and technically difficult to analyze.

Investing in diamonds: Yes or No?

Short-term speculation with diamonds is practically impossible due to the value added tax and the high spreads. This can also be used as a basic argument against diamonds as a value investment, because the investor is first of all in the red with 19 percent after the purchase and has to reckon with further discounts when selling. In addition, there is the lack of a global reference price, as it is available to potential gold investors with the London gold price.

These thoughts should not be understood as a fundamental recommendation against buying diamonds, but rather as an invitation to critically reflect on a potential purchase decision.