Tax advisor near you for private + company: tips, recommendation & evaluation

Nearby Tax Accountants – Find a good tax accountant near you? We have searched the internet for you for days to find the best recommendations for tax consultants near you: Hamburg, Berlin, Cologne, Düsseldorf, Munich, Stuttgart & Co. For your private tax return or income tax return or more complex accounting for companies, from monthly financial accounting to annual financial statements. Taxes in Germany are complex if you lack the necessary knowledge. Here you will find recommendations for tax consultants in your city, including addresses, phone numbers and websites. At the end, our tax advisor XXL guide with links to articles such as tax advisor costs or the typical mistakes when hiring, which make especially self-employed in the company formation.

Tax consultants in Germany: Valuations

Education allowance, income tax, mileage allowance & Co. – the annual tax return presents both entrepreneurs and private individuals with a major challenge every time. This is where the help of a tax advisor comes in handy. They not only support you in preparing your tax return, but also represent you in tax matters before the tax authorities, advise you on asset and property management and also support you in payroll accounting. We have listed the best tax advisors in your city for you here.

Tip. What does a tax consultant cost?

How much does a tax consultant cost per hour? How are the fees of the tax advisor calculated? How much should a tax accountant cost? And how much does a small business tax accountant cost? If you haven’t experienced tax accountants yet, here are official costs and rates for you, from the Federal Board of Tax Appeals. Tip. Under the explanation of value fee you will find the cost table for 100.000, 200.000 and 500.000 Euro – that’s how much your tax advisor costs / earns! What does a tax consultant cost? Here you will find the answer:

Tax consultant costs

Submit your tax return: On average, 1,027 euros in taxes returned

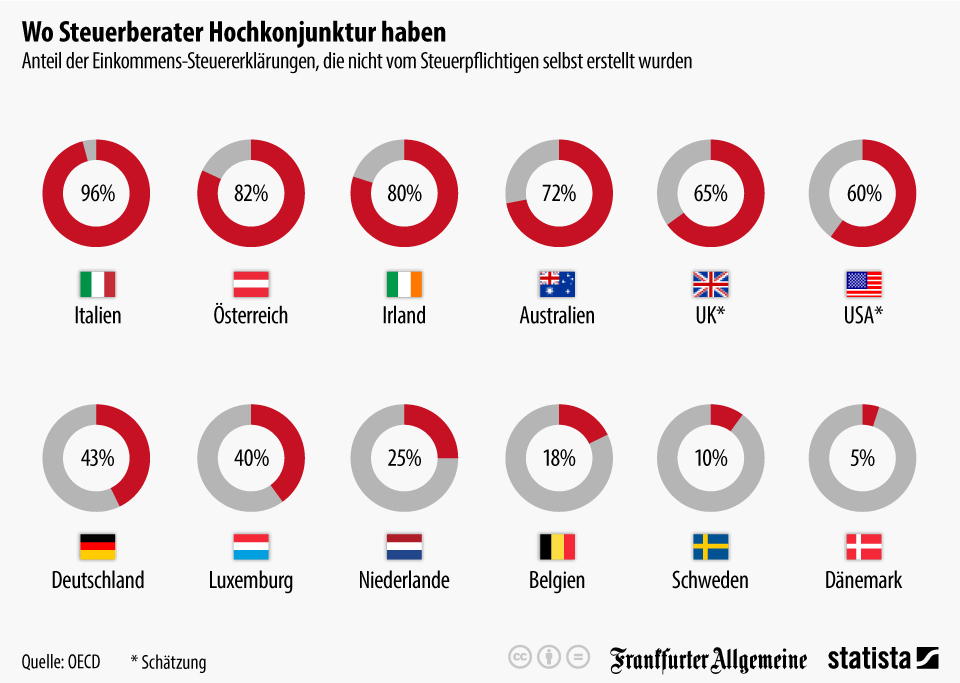

According to OECD, 57% of Germans do their tax return themselves and without a tax advisor! Filing a tax return is worthwhile, on average everyone who files a tax return gets 1,027 euros in taxes back (source: Federal Statistical Office 2020).

Many say that the German tax system is too complicated. But the fact is that the vast majority of taxpayers in Germany do their tax returns themselves, according to OECD statistics. Would you have thought that? Only 43% of Germans use a middleman for their tax return, for example a good and experienced tax advisor in the vicinity. 13.7 million of these taxpayers had their income tax assessed.

Of these, 12 million taxpayers received a tax refund.

The tax refund was on average 1,027 euros

Refunds of between 100 and 1,000 euros were particularly frequent (58 %). In 9 % of the cases, the refund was less than 100 euros. The tax offices refunded amounts in excess of €5,000 in as many as 2% of cases.

Baden-Württemberg

Karlsruhe

Stuttgart

In research!

Bavaria

Augsburg

Freiburg

Munich

Munich Ramersdorf-Perlach, Neuhausen-Nymphenburg, Bogenhausen or Schwabing-Freimann. Here you can find good tax advisor recommendations from Munich:

Nuremberg

Nuremberg Galgenhof, Glockenhof, St. Leonhard, Kornburg, Worzeldorf or Steinbühl, here you will find good tax advisor recommendations:

Berlin

Brandenburg

Potsdam

In research!

Bremen

Hamburg

Hesse

Frankfurt

Wiesbaden

Mecklenburg-Western Pomerania

Schwerin

In research!

Lower Saxony

Hanover

North Rhine-Westphalia

Bielefeld

Bochum

Bonn

Dortmund

Düsseldorf

Food

Cologne

Rhineland-Palatinate

Mainz

Saarland

Saarlouis

In research!

Saxony

Dresden

Saxony-Anhalt

Magdeburg

In research!

Schleswig-Holstein

Kiel

Thuringia

Erfurt

In research!

Tax consultant XXL: Tips, costs + more

Learn even more about finding and hiring a tax advisor here, as well as the most common mistakes when hiring a tax advisor.

Find and hire a tax consultant

Do I have to hire a tax consultant? What tasks does a tax consultant perform? How much does a tax consultant cost? Here you will find the answers to your questions and much more information on the subject of tax consultants in the area, finding tax consultants, costs, tasks, financial accounting, annual financial statements and taxes in general – but let’s start at the beginning.

Costs and billing

How much does a tax consultant cost per hour? How are the fees of the tax advisor calculated? How much should a tax accountant cost? And how much does a small business tax accountant cost? If you haven’t experienced tax accountants yet, here are official costs and rates for you, from the Federal Board of Tax Appeals. Tip. Under the explanation of value fee you will find the cost table for 100.000, 200.000 and 500.000 Euro – that’s how much your tax advisor costs / earns!

Tax consultant costs

Mistakes: 3 risks for your company

Hiring a tax accountant / mistakes – You want to find a good tax accountant! Because, you want to avoid risks and dangers, after all it will cost you cash if you hire the wrong firm for your accounting. Costs for additional processing, advice and service and of course losses, for example, if tax benefits are not taken (quote above). In the article on Lukinski, 3 specific risk factors are described that usually only become apparent after years of working together. The 3 risks first at a glance.