What does a tax consultant cost? Costs per hour / year for consulting, accounting, balance sheet & Co.

Tax Advisor Fees – How much does a tax advisor cost per hour? How are tax accountant fees calculated? How much should a tax accountant cost? And how much does a small business tax accountant cost? If you’re new to tax accountants, here are official costs and rates for you, from the federal Tax Accountants Chamber. Tip. Under the explanation of value fee you will find the cost table for 100.000, 200.000 and 500.000 Euro – that’s how much your tax advisor costs / earns!

Tax advisor near you for private + company

Finding a good tax accountant near you? We have searched the internet for days to find the best recommendations for tax advisors in your area: Hamburg, Berlin, Cologne, Düsseldorf, Munich, Stuttgart & Co. for your private tax return or income tax return or more complex accounting for companies, from monthly financial accounting to annual financial statements. Including addresses, telephone numbers and website.

- All cities: Tax consultants Germany

- Tax consultant Berlin

- Tax consultant Düsseldorf

- Tax consultant Frankfurt

- Tax consultant Hamburg

- Tax consultant Hanover

- Tax consultant Cologne

- Tax consultant Munich

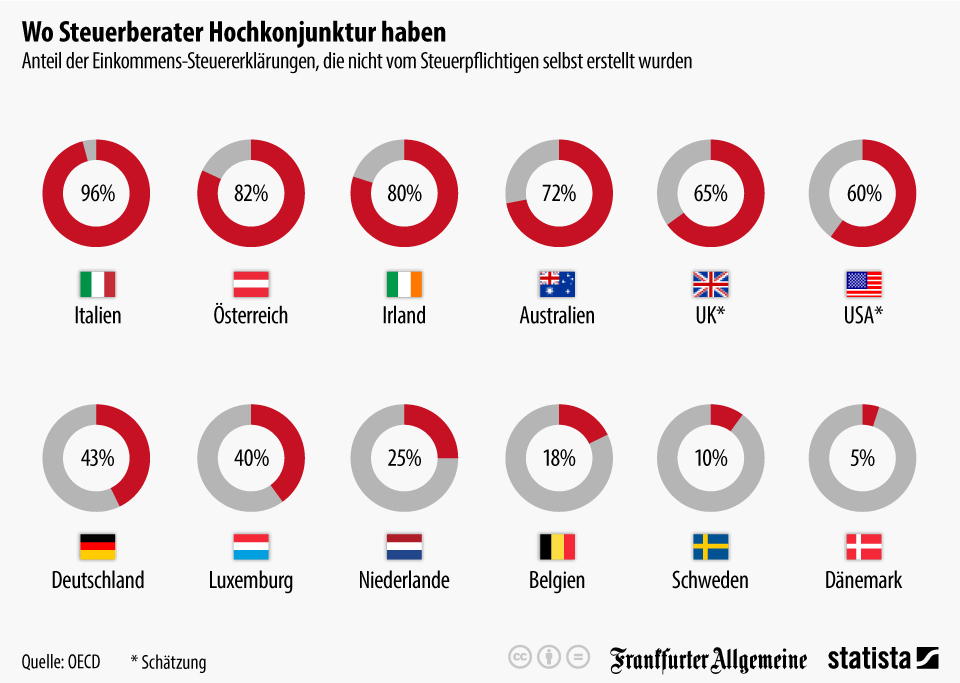

Did you know? Only 57% do their own tax return! Yet you get an average of 1,027 euros in tax back when you file a tax return.

Tax tips for private individuals: 1,027 euros back in taxes!

Many say that the German tax system is too complicated. But the fact is that the vast majority of taxpayers in Germany do their tax returns themselves, according to OECD statistics. Would you have thought that? Only 43% of Germans use a middleman for their tax return, for example a good and experienced tax advisor in the vicinity. 13.7 million of these taxpayers had their income tax assessed.

Of these, 12 million taxpayers received a tax refund.

The tax refund was on average 1,027 euros

Refunds of between 100 and 1,000 euros were particularly frequent (58 %). In 9 % of the cases, the refund was less than 100 euros. The tax offices refunded amounts in excess of €5,000 in as many as 2% of cases.

Value fee: Basis of calculation

Before looking at the cost tables, here’s a quick explanation of what the ad valorem fee is all about. Source: Federal Chamber of Tax Advisors.

Most of the fee elements of the StBVV, such as the preparation of the bookkeeping according to § 33 or also the preparation of the annual financial statements according to § 35 Para. 1 No. 1a, are basically based on value fees (§ 10).

The value fee is calculated according to the value of the object of the professional activity – the so-called Gegenstandswert – and is determined according to the fee tables A to E of the StBVV and the applicable rate per tenth. The specific amount of a fee thus results from the value of the subject matter of the tax advisor’s activity, the application of a rate per tenth for this activity and the corresponding fee table of the StBVV.

Value of the activity = tenths of a percent

Examples of ad valorem fees:

- For the preparation of an income tax return without determining the individual income, the tax advisor receives 1/10 to 6/10 of a full fee according to Table A. The average fee is therefore 3.5/10. The value in dispute is the sum of the positive income, but at least 8,000 Euros (see § 24 Paragraph 1 No. 1 StBVV).

- The monthly fee for bookkeeping, including the account assignment of vouchers, amounts to 2/10 to 12/10 of a full fee according to Table C. The average fee is 7/10. The amount in dispute is the highest amount resulting from the annual turnover or the sum of the expenses (see Section 33 (1) and (4) StBVV).

- For the determination of the excess of business income over business expenses, the tax advisor receives 5/10 to 20/10 of a full fee according to Table B. The average fee is 12.5/10. The average fee is 12.5/10. The amount in dispute is the higher of the sum of the business income and the sum of the business expenses, but at least 12,500 euros.

- For the preparation of annual financial statements (balance sheet and GUV) the fee is 10/10 to 40/10 of a full fee according to Table B. The average fee is 25/10. The average fee is 25/10. The value in dispute is the average between the adjusted balance sheet total and the annual operating performance (§ 35 Para. 1 No. 1 and Para. 2 No. 1 StBVV).

The following is a look at the resulting tax tables.

- Tax law – All cost centers

Tax consultant costs: Examples

Value of the activity? Ten percent rate? Here in the practical example the costs for the tax consultant:

Turnover / income of 100,000 euros

This is how much your tax consultant earns for a turnover of 100,000 euros for balance sheets, EÜR, income tax returns & Co.

| Subject | Minimum fee | Medium fee | Maximum fee |

| Balance | 10/10 311,- |

25/10 778,- |

40/10 1244,- |

| Appendix | 2/10 62,- |

7/10 218,- |

12/10 373,- |

| EÜR | 5/10 156,- |

12.5/10 389,- |

20/10 622,- |

| Income tax return | 1/10 142,- |

3.5/10 498,- |

6/10 853,- |

| Separate determination | 1/10 142,- |

3/10 427,- |

5/10 711,- |

| Corporate income tax return | 1/10 142,- |

3/10 427,- |

5/10 711,- |

| Trade tax return | 1/10 142,- |

3.5/10 498,- |

6/10 853,- |

| VAT return | 1/10 142,- |

4.5/10 640,- |

8/10 1138,- |

| Income from renting | 1/20 71,- |

6.5/20 462,- |

12/20 853,- |

| Income from capital assets | 1/20 71,- |

6.5/20 462,- |

12/20 853,- |

| Income pension | 1/20 71,- |

6.5/20 462,- |

12/20 853,- |

| Accounting | 2/10 379,- |

7/10 1327,- |

12/10 2275,- |

| Payroll accounting (per employee) | 15/MA 75,- |

20/MA 100,- |

25/MA 125,- |

| Time fee (by the hour) | -300 | -500 | -700 |

Turnover / income of 200,000 euros

This is how much your tax consultant earns for a turnover of 200,000 euros for balance sheets, EÜR, income tax returns & Co.

| Subject | Minimum fee | Medium fee | Maximum fee |

| Balance | 10/10 462,- |

25/10 1155,- |

40/10 1848,- |

| Appendix | 2/10 92,- |

7/10 323,- |

12/10 554,- |

| EÜR | 5/10 231,- |

12.5/10 578,- |

20/10 924,- |

| Income tax return | 1/10 191,- |

3.5/10 667,- |

6/10 1144,- |

| Separate determination | 1/10 191,- |

3/10 572,- |

5/10 954,- |

| Corporate income tax return | 1/10 191,- |

3/10 572,- |

5/10 954,- |

| Trade tax return | 1/10 191,- |

3.5/10 667,- |

6/10 1144,- |

| VAT return | 1/10 191,- |

4.5/10 858,- |

8/10 1526,- |

| Income from renting | 1/20 95,- |

6.5/20 620,- |

12/20 1144,- |

| Income from capital assets | 1/20 95,- |

6.5/20 620,- |

12/20 1144,- |

| Income pension | 1/20 95,- |

6.5/20 620,- |

12/20 1144,- |

| Accounting | 2/10 554,- |

7/10 1940,- |

12/10 3326,- |

| Payroll accounting (per employee) | 15/MA 120,- |

20/MA 160,- |

25/MA 200,- |

| Time fee (by the hour) | 360 | 600 | 840 |

Turnover / income of 500,000 euros

This is how much your tax consultant earns for a turnover of 500,000 euros for balance sheets, EÜR, income tax returns & Co.

| Subject | Minimum fee | Medium fee | Maximum fee |

| Balance | 10/10 701,- |

25/10 1753,- |

40/10 2804,- |

| Appendix | 2/10 140,- |

7/10 491,- |

12/10 841,- |

| EÜR | 5/10 351,- |

12.5/10 876,- |

20/10 1402,- |

| Income tax return | 1/10 272,- |

3.5/10 953,- |

6/10 1634,- |

| Separate determination | 1/10 272,- |

3/10 817,- |

5/10 1362,- |

| Corporate income tax return | 1/10 272,- |

3/10 817,- |

5/10 1362,- |

| Trade tax return | 1/10 272,- |

3.5/10 953,- |

6/10 1634,- |

| VAT return | 1/10 272,- |

4.5/10 1226,- |

8/10 2179,- |

| Income from renting | 1/20 136,- |

6.5/20 885,- |

12/20 1634,- |

| Income from capital assets | 1/20 136,- |

6.5/20 885,- |

12/20 1634,- |

| Income pension | 1/20 136,- |

6.5/20 885,- |

12/20 1634,- |

| Accounting | 2/10 1034,- |

7/10 3620,- |

12/10 6206,- |

| Payroll accounting (per employee) | 15/MA 225,- |

20/MA 300,- |

25/MA 375,- |

| Time fee (by the hour) | -600 | -1000 | -1400 |

Tax law: § 13 Time fee

The time fee is to be charged:

1. in cases where this Regulation so provides,

2. if there are no sufficient indications for an estimate of the object value; this shall not apply to activities pursuant to section 23 as well as to representation in out-of-court appeal proceedings (section 40), in administrative enforcement proceedings (section 44) and in court and other proceedings (sections 45, 46).

It amounts to 30 to 75 Euro per half hour or part thereof.

Find tax consultant, hire

Learn even more about finding and hiring a tax advisor here, as well as the most common mistakes when hiring a tax advisor.

Find and hire a tax consultant

Do I have to hire a tax consultant? What tasks does a tax consultant perform? How much does a tax consultant cost? Here you will find the answers to your questions and much more information on the subject of tax consultants in the area, finding tax consultants, costs, tasks, financial accounting, annual financial statements and taxes in general – but let’s start at the beginning.

Tax consultant in the vicinity

Nearby Tax Accountants – Find a good tax accountant near you? We have searched the internet for you for days to find the best recommendations for tax consultants in your area: Hamburg, Berlin, Cologne, Dusseldorf, Munich, Stuttgart & Co. for your private tax return or income tax return or more complex accounting for companies, from monthly financial accounting to annual financial statements. Including addresses, telephone numbers and website.

Mistakes: 3 risks for your company

Hiring a tax accountant / mistakes – You want to find a good tax accountant! Because, you want to avoid risks and dangers, after all it will cost you cash if you hire the wrong firm for your accounting. Costs for additional processing, advice and service and of course losses, for example, if tax benefits are not taken (quote above). In the article on Lukinski, 3 specific risk factors are described that usually only become apparent after years of working together. The 3 risks first at a glance.